Business, 19.02.2020 00:03 tiarafaimealelei

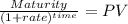

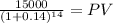

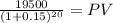

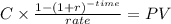

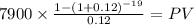

How much would you have to invest today to receive the following? Use Appendix B and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a.$15,000 in 10 years at 14 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)b.$19,500 in 20 years at 15 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places. c.$7,900 each year for 19 years at 12 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)d.$54,000 each year for 50 years at 10 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

Answers: 2

Another question on Business

Business, 22.06.2019 01:20

Cindy recently played in a softball game in which she misplayed a ground ball for an error. later, in the same game, she made a great catch on a very difficult play. according to the self-serving bias, she would attribute her error to and her good catch to her

Answers: 1

Business, 22.06.2019 11:50

Select the correct answer. ramon applied to the state university in the city where he lives, but he was denied admission. what should he do now? a.change his mind about graduating and drop out of high school so he can start working right away. b. decide not to go to college, because he didn’t have a backup plan. c.stay positive and write a mean letter to let the college know that they made a bad decision. d. learn from this opportunity, reevaluate his options, and apply to his second and third choices.

Answers: 2

Business, 22.06.2019 23:50

Melissa buys an iphone for $240 and gets consumer surplus of $160. a. what is her willingness to pay? b. if she had bought the iphone on sale for $180, what would her consumer surplus have been?

Answers: 3

Business, 23.06.2019 00:30

Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 20 years. assume you purchase a bond that costs $25. a. what is the exact rate of return you would earn if you held the bond for 20 years until it doubled in value? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. if you purchased the bond for $25 in 2017 at the then current interest rate of .27 percent year, how much would the bond be worth in 2027? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. in 2027, instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2037. what annual rate of return will you earn over the last 10 years? (do not

Answers: 3

You know the right answer?

How much would you have to invest today to receive the following? Use Appendix B and Appendix D for...

Questions

Mathematics, 01.12.2020 01:00

Mathematics, 01.12.2020 01:00

Spanish, 01.12.2020 01:00

Mathematics, 01.12.2020 01:00

Mathematics, 01.12.2020 01:00

Biology, 01.12.2020 01:00

Biology, 01.12.2020 01:00