Answers: 3

Another question on Business

Business, 22.06.2019 16:00

Winners of the georgia lotto drawing are given the choice of receiving the winning amount divided equally over 2121 years or as a lump-sum cash option amount. the cash option amount is determined by discounting the annual winning payment at 88% over 2121 years. this week the lottery is worth $1616 million to a single winner. what would the cash option payout be?

Answers: 3

Business, 22.06.2019 23:00

Investors who put their own money into a startup are known as a. mannequins b. obligators c. angels d. borrowers

Answers: 1

Business, 23.06.2019 01:30

Lee earns $1,482 of interest in 270 days after making a deposit of $15,200. find the interest rate.

Answers: 1

Business, 23.06.2019 11:30

Alia valbuena earns 68,400 per year as an automotive engineet what is her weekly and monthly salary ?

Answers: 1

You know the right answer?

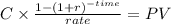

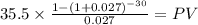

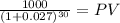

Dufner Co. issued 15-year bonds one year ago at a coupon rate of 7.1 percent. The bonds make semi-an...

Questions

Mathematics, 27.07.2019 19:00

Health, 27.07.2019 19:00

Mathematics, 27.07.2019 19:00

Mathematics, 27.07.2019 19:00

Mathematics, 27.07.2019 19:00

English, 27.07.2019 19:00

Mathematics, 27.07.2019 19:00

Biology, 27.07.2019 19:00

Computers and Technology, 27.07.2019 19:00

Physics, 27.07.2019 19:00

Mathematics, 27.07.2019 19:00