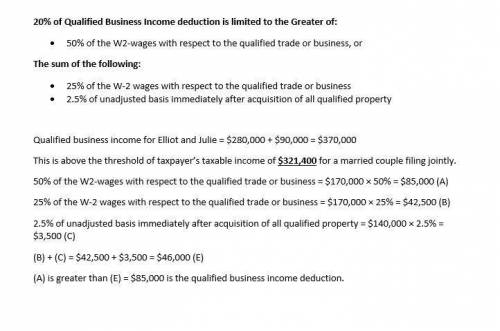

Elliot operates his clothing store as a single member LLC (which he reports as a sole proprietorship). In 2019, his proprietorship generates qualified business income of $280,000, he pays W–2 wages of $170,000, and he has qualified business property of $140,000. Elliot’s wife, Julie, is an attorney who works for a local law firm and receives wages of $90,000. They will file a joint tax return and use the standard deduction. What is Elliot’s qualified business income deduction?

Answers: 3

Another question on Business

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

Business, 22.06.2019 20:00

Which of the following is a competitive benefit experienced by the first mover firm in an industry? a. the first mover will be able to achieve a less steep learning curve. b. the first mover will be able to reduce the switching costs. c. the first mover will not have to patent its products or technology. d. the first mover will be able to reduce costs through economies of scale.

Answers: 3

Business, 23.06.2019 00:30

Industrial engineers who specialize in ergonomics are concerned with designing workspace and devices operated by workers so as to achieve high productivity and comfort. a paper published in this research area reports on a study of preferred height for an experimental keyboard with large forearm-wrist support. a sample of 31 trained typists resulted in an average preferred height of 80.0 cm

Answers: 1

Business, 23.06.2019 01:20

Which of the following is true about presentation methods for providing training? audiovisual techniques are most effective when they are used alone. mobile technologies include training methods such as on-the-job training, simulations, business games and case studies, behavior modeling, interactive video, and web-based training that require the trainee to be actively involved in learning. the typical users for teleconferencing include employees who are part of a workforce that spends most of its time traveling, visiting customers or various company locations and has limited time available to spend in traditional training activities. webcasting involves classroom instructions that are provided online through live broadcasts. classroom instruction is no longer a popular training method because of new technologies such as interactive video and computer-assisted instruction.

Answers: 1

You know the right answer?

Elliot operates his clothing store as a single member LLC (which he reports as a sole proprietorship...

Questions

Mathematics, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

History, 19.11.2019 03:31

History, 19.11.2019 03:31

Geography, 19.11.2019 03:31

Mathematics, 19.11.2019 03:31

Social Studies, 19.11.2019 03:31