2019 2018

Business, 20.02.2020 04:02 melanieambrosy

Condensed financial data are presented below for the Phoenix Corporation:

2019 2018

Accounts receivable 267,500 $ 230,000

Inventory 312,500 257,500

Total current assets 670,000 565,000

Intangible assets 50,000 60,000

Total assets 825,000 695,000

Current liabilities 252,500 200,000

Long-term liabilities 77,500 75,000

Sales 1,640,000

Cost of goods sold 982,500

Interest expense 10,000

Income tax expense 77,500

Net income 127,500

Cash flow from operations 71,000

Cash flow from investing activities (6,000 )

Cash flow from financing activities (62,500 )

Tax rate 30 %

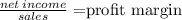

The profit margin used to calculate return on assets, operating margin, recivable turnover, return on equty and quick ratio for 2019 is

The inventory turnover for 2019 is (rounded):

Answers: 1

Another question on Business

Business, 22.06.2019 10:30

Jack manufacturing company had beginning work in process inventory of $8,000. during the period, jack transferred $34,000 of raw materials to work in process. labor costs amounted to $41,000 and overhead amounted to $36,000. if the ending balance in work in process inventory was $12,000, what was the amount transferred to finished goods inventory?

Answers: 2

Business, 22.06.2019 18:10

Ashop owner uses a reorder point approach to restocking a certain raw material. lead time is six days. usage of the material during lead time is normally distributed with a mean of 42 pounds and a standard deviation of four pounds. when should the raw material be reordered if the acceptable risk of a stockout is 3 percent?

Answers: 1

Business, 22.06.2019 20:10

Quick computing currently sells 12 million computer chips each year at a price of $19 per chip. it is about to introduce a new chip, and it forecasts annual sales of 22 million of these improved chips at a price of $24 each. however, demand for the old chip will decrease, and sales of the old chip are expected to fall to 6 million per year. the old chips cost $10 each to manufacture, and the new ones will cost $14 each. what is the proper cash flow to use to evaluate the present value of the introduction of the new chip? (enter your answer in millions.)

Answers: 1

Business, 22.06.2019 21:00

Identify whether the statements are true or false by dragging and dropping the appropriate term into the bin provided. long-run economic growth is unlikely to be sustainable because of finite natural resources. in the modern economy, countries that possess few domestic natural resources essentially have no chance to develop economically. finding alternatives to natural resources will be very important to long-term economic growth. in the modern economy, human and physical capital are generally less important in productivity than natural resources. in the 19th century, countries with the highest per capita gdp were nearly always abundant in minerals and productive farming land.

Answers: 1

You know the right answer?

Condensed financial data are presented below for the Phoenix Corporation:

2019 2018

2019 2018

Questions

History, 19.08.2019 02:30

Mathematics, 19.08.2019 02:30

Mathematics, 19.08.2019 02:30

Mathematics, 19.08.2019 02:30

Biology, 19.08.2019 02:30

Biology, 19.08.2019 02:30