The Carbondale Hospital is considering the purchase of a new ambulance. The decision will rest partly on the anticipated mileage to be driven next year. The miles driven during the past 5 years are as follows:

Year

1

2

3

4

5

Mileage

3,100 (1)

4,000 (2)

3,500 (3)

3,800(4)

3,800(5)

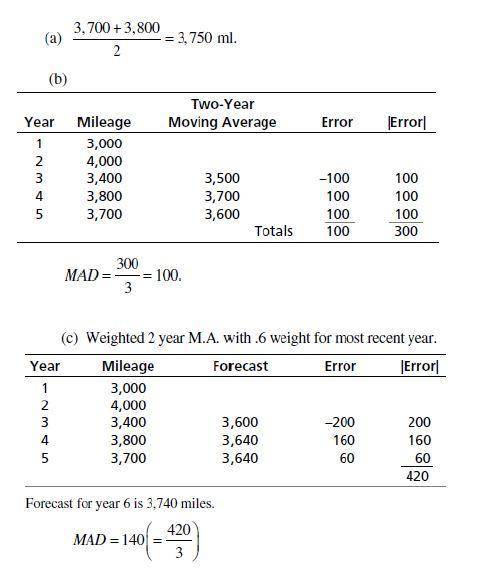

a) Using a 2-year moving average, the forecast for year 6 = 3800

miles (round your response to the nearest whole number).

b) If a 2-year moving average is used to make the forecast, the MAD based on this = nothing

miles (round your response to one decimal place). (Hint: You will have only 3 years of matched data.)

c) The forecast for year 6 using a weighted 2-year moving average with weights of 0.40

and 0.60

(the weight of 0.60

is for the most recent period) = nothing

miles (round your response to the nearest whole number).

The MAD for the forecast developed using a weighted 2-year moving average with weights of 0.40

and 0.60

= nothing

miles (round your response to one decimal place). (Hint: You will have only 3 years of matched data.)

d) Using exponential smoothing with alpha

= 0.50

and the forecast for year 1 being 3,000

,

the forecast for year 6 = nothing

miles (round your response to the nearest whole number).

Answers: 3

Another question on Business

Business, 21.06.2019 14:40

Easel manufacturing budgeted fixed overhead costs of $ 1.50 per unit at an anticipated production level of 1 comma 350 units. in july easel incurred actual fixed overhead costs of $ 4 comma 700 and actually produced 1 comma 300 units. what is easel's fixed overhead budget variance for july?

Answers: 2

Business, 21.06.2019 23:30

Consider the following scenarios. use what you have learned to decide if the goods and services being provided are individual, public, or merit goods. for each case, state what kind of good has been described and explain your answer using the definitions of individual, public, and merit goods. (6 points each) 1. from your window, you can see a city block that's on fire. you watch city firefighters rescue people and battle the flames to save the buildings. 2. while visiting relatives, you learn that your cousins attend a nearby elementary school that is supported financially by local property tax revenue. 3. you see a squadron of military jets flying overhead. 4. you find out that your aunt works for a defense manufacturing company that has several defense contracts with the government. she tells you that she works for a team that is producing a communications satellite. 5. your class visits a local jail run by a private, profit-making company that detains county criminals and is paid with tax revenue.

Answers: 1

Business, 22.06.2019 03:30

In return for their with optimizing his painting project, the castle servant informed poly and digit that he saw someone dressed as the king leaving behind a trail of crumbs as he walked into the jester's room late last night. poly and digit have finally found the crisp-collecting culprit — it turns out the jester's shoe size and hair color match the clues that were found! in gratitude, poly and digit agree to the servant with his current task of replacing all of the tables and chairs in the castle. his goal is to determine which furniture company should produce the new furniture. he receives information from a company that customizes elegant furniture, and he wants to analyze the company's production process in order to calculate some problems about cost and availability. read the following scenario, and assist poly and digit as they the servant with his calculations. the fit for a king furniture company requires 2020 hours of labor to produce a standard table, and a chair requires 1212 hours of labor. the labor available is 565565 hours per week. the company can produce at most 3535 chairs per week.

Answers: 1

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

You know the right answer?

The Carbondale Hospital is considering the purchase of a new ambulance. The decision will rest partl...

Questions

Mathematics, 28.12.2021 20:10

SAT, 28.12.2021 20:10

SAT, 28.12.2021 20:10

Physics, 28.12.2021 20:10

SAT, 28.12.2021 20:10

Business, 28.12.2021 20:10

History, 28.12.2021 20:20

SAT, 28.12.2021 20:20

Social Studies, 28.12.2021 20:20

SAT, 28.12.2021 20:20

Physics, 28.12.2021 20:20

SAT, 28.12.2021 20:20