Business, 22.02.2020 01:42 andreastyles1603

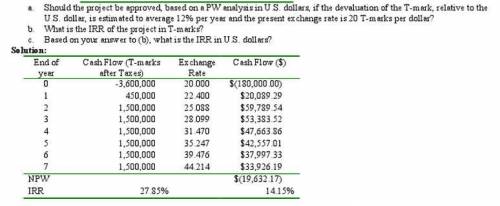

A U. S company is considering a high-technology project in a foreign country. The estimated economic results for the project (after taxes), in the foreign currency (T-marks), is shown in the following table for the seven-year analysis period being used. The company requires an 18% rate of return in U. S. dollars (after taxes) on any investments in this foreign country.

End of Year Cash Flow (T-marks after Taxes)

0 -3,600,000

1 450,000

2 1,500,000

3 1,500,000

4 1,500,000

5 1,500,000

6 1,500,000

7 1,500,000

a. Should the project be approved, based on a PW analysis in U. S. dollars, if the devaluation of the T-mark, relative to the U. S. dollar, is estimated to average 12% per year and the present exchange rate is 20 T-marks per dollar?

b. What is the IRR of the project in T-marks?

c. Based on your answer to (b), what is the IRR in U. S. dollars?

Answers: 2

Another question on Business

Business, 22.06.2019 11:10

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

Business, 22.06.2019 11:30

Florence invested in a factory requiring. federally-mandated reductions in carbon emissions. how will this impact florence as the factory's owner? a. her factory will be worth less once the upgrades are complete. b. her factory will likely be bought by the epa. c. florence will have to invest a large amount of capital to update the factory for little financial gain. d. florence will have to invest a large amount of capital to update the factory for a large financial gain.

Answers: 1

Business, 22.06.2019 12:50

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Business, 22.06.2019 14:30

Turtle corporation produces and sells a single product. data concerning that product appear below: per unit percent of sales selling price $ 150 100 % variable expenses 75 50 % contribution margin $ 75 50 % the company is currently selling 5,600 units per month. fixed expenses are $194,000 per month. the marketing manager believes that a $5,300 increase in the monthly advertising budget would result in a 190 unit increase in monthly sales. what should be the overall effect on the company's monthly net operating income of this change?

Answers: 1

You know the right answer?

A U. S company is considering a high-technology project in a foreign country. The estimated economic...

Questions

World Languages, 05.02.2021 07:50

Social Studies, 05.02.2021 07:50

English, 05.02.2021 07:50

Mathematics, 05.02.2021 07:50

Physics, 05.02.2021 07:50

Geography, 05.02.2021 07:50

Mathematics, 05.02.2021 07:50

Mathematics, 05.02.2021 07:50

Mathematics, 05.02.2021 07:50

Mathematics, 05.02.2021 07:50

Mathematics, 05.02.2021 07:50