Business, 22.02.2020 02:07 venancialee8805

On January 1, 2014, Aumont Company sold 12% bonds having a maturity value of $500,000 for $537,907, which provides the bondholders with a 10% yield. The bonds are dated January 1, 2014, and mature January 1, 2019, with interest payable December 31 of each year. Aumont Company allocates interest and unamortized discount or premium on the effective-interest basis.

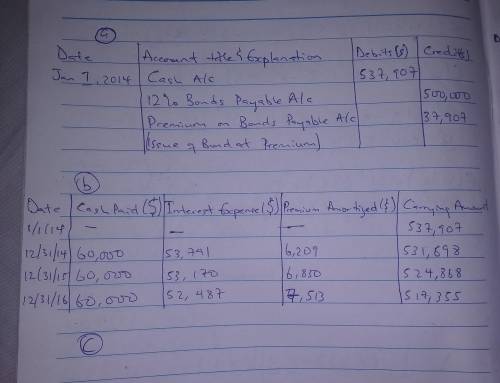

(a) Prepare the journal entry at the date of the bond issuance. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

January 1, 2014

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

(b) Prepare a schedule of interest expense and bond amortization for 2014?2016. (Round answers to 0 decimal places, e. g. 38,548.)

Schedule of Interest Expense and Bond Premium Amortization

Effective-Interest Method

Date

Cash

Paid

Interest

Expense

Premium

Amortized

Carrying

Amount of Bonds

1/1/14 $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds $On January 1, 2014, Aumont Company sold 12% bonds

12/31/14 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

12/31/15 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

12/31/16 On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds On January 1, 2014, Aumont Company sold 12% bonds

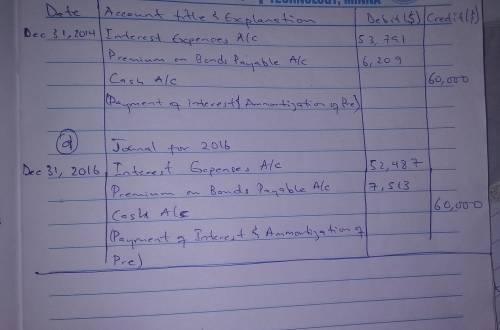

(c) Prepare the journal entry to record the interest payment and the amortization for 2014. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

December 31, 2014

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

(d) Prepare the journal entry to record the interest payment and the amortization for 2016. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

December 31, 2016

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

On January 1, 2014, Aumont Company sold 12% bonds

Answers: 3

Another question on Business

Business, 22.06.2019 04:00

Match the type of agreements to their descriptions. will trust living will prenuptial agreement

Answers: 2

Business, 22.06.2019 16:50

The cost of labor is significantly lower in many countries than in the united states. if you move manufacturing to a facility to a country labeled as part of the axis of evil and a threat to world peace you will increase the net income of your client by $10 million per the facility is located in a country which limits personal freedom and engages in state sponsored terrorism. imagine you are a marketing consultant. (a) what would you tell the executives to do? (b) what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 1

Business, 23.06.2019 13:00

How should the financial interests of stockholders be balanced with varied interests of stakeholders? if you were writing a code of conduct for your company, how would you address this issue?

Answers: 1

You know the right answer?

On January 1, 2014, Aumont Company sold 12% bonds having a maturity value of $500,000 for $537,907,...

Questions

Mathematics, 11.03.2021 23:20

Mathematics, 11.03.2021 23:20

Mathematics, 11.03.2021 23:20

Computers and Technology, 11.03.2021 23:20

Mathematics, 11.03.2021 23:20

Social Studies, 11.03.2021 23:20

English, 11.03.2021 23:20

Mathematics, 11.03.2021 23:20

Mathematics, 11.03.2021 23:20