Business, 22.02.2020 02:58 quise2ross

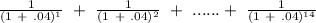

A bank offers you a $1M loan with an IRR of 4% (i. e. the bank makes a return of 4% on the loan). The bank requires you to repay the loan in 14 equal annual installments, starting next year.(a) What is the annual payment on the loan, to the nearest dollar

Answers: 1

Another question on Business

Business, 22.06.2019 10:30

Perez, inc., applies the equity method for its 25 percent investment in senior, inc. during 2018, perez sold goods with a 40 percent gross profit to senior, which sold all of these goods in 2018. how should perez report the effect of the intra-entity sale on its 2018 income statement?

Answers: 2

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 18:00

What would not cause duff beer’s production possibilities curve to expand in the short run? a. improved manufacturing technology b. additional resources c. increased demand

Answers: 1

Business, 22.06.2019 20:00

Which motion below could be made so that the chair would be called on to enforce a violated rule?

Answers: 2

You know the right answer?

A bank offers you a $1M loan with an IRR of 4% (i. e. the bank makes a return of 4% on the loan). Th...

Questions

Social Studies, 23.01.2020 00:31

Business, 23.01.2020 00:31

Mathematics, 23.01.2020 00:31

Mathematics, 23.01.2020 00:31

= 10.5631

= 10.5631