Business, 22.02.2020 03:15 Mikkixo3114

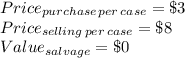

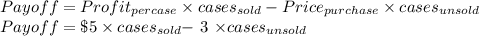

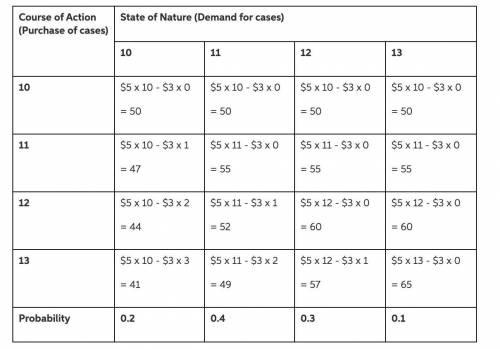

Jean Clark is the manager of the Midtown Safeway Grocery Store. She now needs to replenish her supply of strawberries. Her regular supplier can provide as many cases as she wants. However, because these strawberries already are very ripe, she will need to sell them tomorrow and then discard any that remain unsold. Jean estimates that she will be able to sell 10, 11, 12, or 13 cases tomorrow. She can purchase the strawberries for $3 per case and sell them for $8 per case. Jean now needs to decide how many cases to purchase.

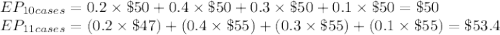

Jean has checked the store’s records on daily sales of strawberries. On this basis, she estimates that the prior probabilities are 0.2, 0.4, 0.3, and 0.1 for being able to sell 10, 11, 12, and 13 cases of strawberries tomorrow.

1. What are decision variables and what are the states of nature in this problem?

2. Draw and upload the payoff table for this problem. (NOTE: You can draw the table either using software (e. g., Microsoft Paint, PowerPoint) or on a piece of paper and take a picture.)

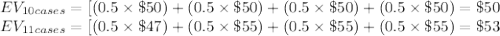

3. If Jean wants to follow the maximin criterion, what should she do and why?

4. How many cases should Jean order if she follows the maximum likelihood criterion? Why?

5. How many cases should Jean order if she follows Bayes' decision rule and why?

6. What's the most Jean should be willing to spend to get more information about how many cases of strawberries she might be able to sell tomorrow?

Answers: 3

Another question on Business

Business, 22.06.2019 12:30

On june 1, 2017, blossom company was started with an initial investment in the company of $22,360 cash. here are the assets, liabilities, and common stock of the company at june 30, 2017, and the revenues and expenses for the month of june, its first month of operations: cash $4,960 notes payable $12,720 accounts receivable 4,340 accounts payable 840 service revenue 7,860 supplies expense 1,100 supplies 2,300 maintenance and repairs expense 700 advertising expense 400 utilities expense 200 equipment 26,360 salaries and wages expense 1,760 common stock 22,360 in june, the company issued no additional stock but paid dividends of $1,660. prepare an income statement for the month of june.

Answers: 3

Business, 22.06.2019 19:40

An increase in the market price of men's haircuts, from $16 per haircut to $26 per haircut, initially causes a local barbershop to have its employees work overtime to increase the number of daily haircuts provided from 20 to 25. when the $26 market price remains unchanged for several weeks and all other things remain equal as well, the barbershop hires additional employees and provides 40 haircuts per day. what is the short-run price elasticity of supply? nothing (your answer should have two decimal places.) what is the long-run price elasticity of supply? nothing (your answer should have two decimal places.)

Answers: 1

Business, 22.06.2019 20:40

Cherokee inc. is a merchandiser that provided the following information: amount number of units sold 20,000 selling price per unit $ 30 variable selling expense per unit $ 4 variable administrative expense per unit $ 2 total fixed selling expense $ 40,000 total fixed administrative expense $ 30,000 beginning merchandise inventory $ 24,000 ending merchandise inventory $ 44,000 merchandise purchases $ 180,000 required: 1. prepare a traditional income statement. 2. prepare a contribution format income statement.

Answers: 2

Business, 23.06.2019 03:20

Milden company has an exclusive franchise to purchase a product from the manufacturer and distribute it on the retail level. as an aid in planning, the company has decided to start using a contribution format income statement. to have data to prepare such a statement, the company has analyzed its expenses and has developed the following cost formulas: cost cost formula cost of good sold $35 per unit sold advertising expense $210,000 per quarter sales commissions 6% of sales shipping expense ? administrative salaries $145,000 per quarter insurance expense $9,000 per quarter depreciation expense $76,000 per quarter management has concluded that shipping expense is a mixed cost, containing both variable and fixed cost elements. units sold and the related shipping expense over the last eight quarters follow: quarter units sold shipping expense year 1: first 10,000 $ 119,000 second 16,000 $ 175,000 third 18,000 $ 190,000 fourth 15,000 $ 164,000 year 2: first 11,000 $ 130,000 second 17,000 $ 185,000 third 20,000 $ 210,000 fourth 13,000 $ 147,000 milden company’s president would like a cost formula derived for shipping expense so that a budgeted contribution format income statement can be prepared for the next quarter. required: 1. using the high-low method, estimate a cost formula for shipping expe

Answers: 2

You know the right answer?

Jean Clark is the manager of the Midtown Safeway Grocery Store. She now needs to replenish her suppl...

Questions

Mathematics, 26.01.2020 14:31

History, 26.01.2020 14:31

Mathematics, 26.01.2020 14:31

Mathematics, 26.01.2020 14:31

Mathematics, 26.01.2020 14:31

Mathematics, 26.01.2020 14:31

English, 26.01.2020 14:31

History, 26.01.2020 14:31

Physics, 26.01.2020 14:31

Geography, 26.01.2020 14:31

Mathematics, 26.01.2020 14:31