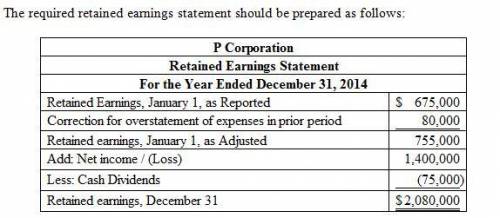

Portman Corporation has retained earnings of $675,000 at January 1, 2014. Net income during 2014 was $1,400,000, and cash dividends declared and paid during 2014 totaled $75,000. Prepare a retained earnings statement for the year ended December 31, 2014. Assume an error was discovered: land costing $80,000 (net of tax) was charged to maintenance and repairs expense in 2011. (List items that increase retained earnings first.)

PORTMAN CORPORATION

Retained Earnings Statement

For the Year Ended December 31, 2014

Correction for Overstatement of Expenses in Prior PeriodCash DividendsExpensesNet Income / (Loss)Retained Earnings, January 1, as AdjustedRetained Earnings, January 1, as ReportedRetained Earnings, December 31RevenuesTotal ExpensesTotal Revenues

$

Correction for Overstatement of Expenses in Prior PeriodCash DividendsExpensesNet Income / (Loss)Retained Earnings, January 1, as AdjustedRetained Earnings, January 1, as ReportedRetained Earnings, December 31RevenuesTotal ExpensesTotal Revenues

Correction for Overstatement of Expenses in Prior PeriodCash DividendsExpensesNet Income / (Loss)Retained Earnings, January 1, as AdjustedRetained Earnings, January 1, as ReportedRetained Earnings, December 31RevenuesTotal ExpensesTotal Revenues

AddLess: Correction for Overstatement of Expenses in Prior PeriodCash DividendsExpensesNet Income / (Loss)Retained Earnings, January 1, as AdjustedRetained Earnings, January 1, as ReportedRetained Earnings, December 31RevenuesTotal ExpensesTotal Revenues

AddLess: Correction for Overstatement of Expenses in Prior PeriodCash DividendsExpensesNet Income / (Loss)Retained Earnings, January 1, as AdjustedRetained Earnings, January 1, as ReportedRetained Earnings, December 31RevenuesTotal ExpensesTotal Revenues

Correction for Overstatement of Expenses in Prior PeriodCash DividendsExpensesNet Income / (Loss)Retained Earnings, January 1, as AdjustedRetained Earnings, January 1, as ReportedRetained Earnings, December 31RevenuesTotal ExpensesTotal Revenues

Answers: 2

Another question on Business

Business, 22.06.2019 07:20

Richardson hired j.c. flood company, a plumbing contractor, to correct a stoppage in the sewer line of her house. the plumbing company's 'snake' device, used to clear the line leading to the main sewer, became caught in the underground line. to release it, the company excavated a portion of the sewer line in richardson's backyard. in the process, the company discovered numerous leaks in a rusty, defective water pipe that ran parallel with the sewer line. to meet public regulations, the water pipe, of a type no longer approved for such service, had to be replaced either then or later, when the yard would have to be excavated again. the plumbing company proceeded to repair the water pipe. though richardson inspected the company's work daily and did not express any objection to the extra work involved in replacing the water pipe, she refused to pay any part of the total bill after the company completed the entire operation. j.c. flood company then sued richardson for the costs of labor and material it had furnished. (c) for what, if anything, should richardson be liable? explain."

Answers: 1

Business, 22.06.2019 11:00

When the federal reserve buys bonds from or sells bonds to member banks, it is called monetary policy reserve ratio interest rate adjustment open market operations

Answers: 1

Business, 22.06.2019 13:30

1. is the act of declaring a drivers license void and terminated when it is determined that the license was issued through error or fraud.

Answers: 2

You know the right answer?

Portman Corporation has retained earnings of $675,000 at January 1, 2014. Net income during 2014 was...

Questions

Chemistry, 16.10.2020 04:01

Social Studies, 16.10.2020 04:01

Mathematics, 16.10.2020 04:01

English, 16.10.2020 04:01

History, 16.10.2020 04:01

English, 16.10.2020 04:01

Mathematics, 16.10.2020 04:01

Mathematics, 16.10.2020 04:01

Biology, 16.10.2020 04:01

Biology, 16.10.2020 04:01