In addition to cash contributions to charity, Dean decided to donate shares of stock and a portrait painted during the earlier part of the last century. Dean purchased the stock and the portrait many years ago as investments. Dean reported the following recipients:

Charity Property Cost FMV

State University Cash $15,000 $15,000

Red Cross Cash 14,500 14,500

State History Museum Painting 5,000 82,000

City Medical Center Dell stock 28,000 17,000

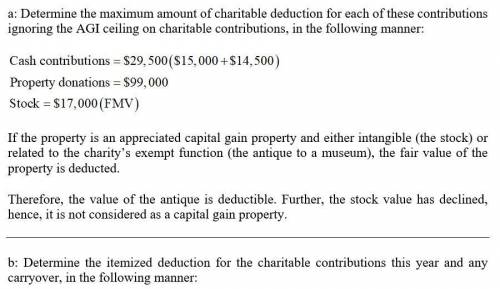

a. Determine the maximum amount of charitable deduction for each of these contributions ignoring the AGI ceiling on charitable contributions.

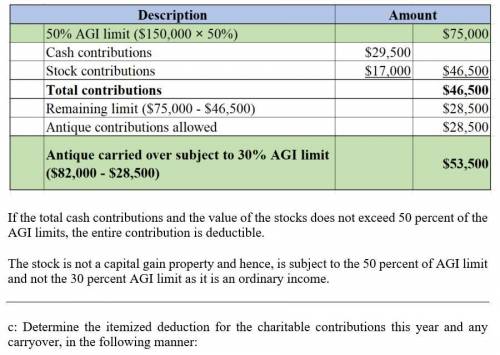

b. Assume that Dean’s AGI this year is $150,000. Determine Dean’s itemized deduction for his charitable contributions this year and any carryover.

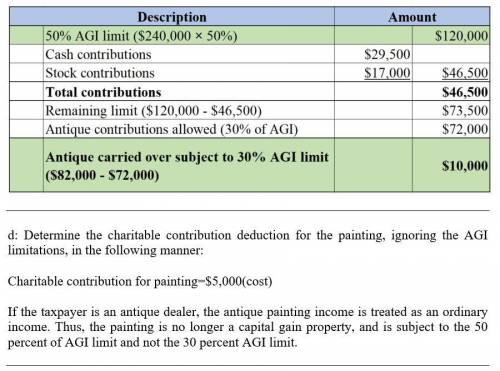

c. Assume that Dean’s AGI this year is $240,000. Determine Dean’s itemized deduction for his charitable contributions this year and any carryover.

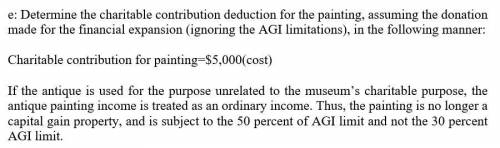

d. Suppose Dean is a dealer in antique paintings and had held the painting for sale before the contribution. What is Dean's charitable contribution deduction for the antique painting in this situation (ignoring AGI limitations)?

e. Suppose that Dean’s objective with the donation to the museum was to finance expansion of the historical collection. Hence, Dean was not surprised when the museum announced the sale of the portrait because of its limited historical value. What is Dean's charitable contribution deduction for the paintings in this situation (ignoring AGI limitations)?

Answers: 1

Another question on Business

Business, 21.06.2019 20:20

while setting up his new office, an attorney ordered thick, frieze carpets for the floor. however, the building inspector had him remove the expensive carpeting. the building inspector stated that according to federal regulations, the office must be wheelchair accessible as it is a public area. he further explained that since wheelchairs do not maneuver well in thick, frieze carpeting, the carpets had to be removed and be replaced with smooth-textured carpets that do not restrict wheelchair maneuverability. this scenario illustrates how a company is influenced by the component of its specific environment.

Answers: 2

Business, 22.06.2019 03:00

Insurance companies have internal controls in place to protect assets, monitor the accuracy of accounting records and encourage operational efficiencies and adherence to policies. these internal controls are generally of two types: administrative controls and accounting controls. administrative controls are the policies and procedures that guide the daily actions of employees. accounting controls are the policies and procedures that delineate authorizations of financial transactions that are done, safeguard assets, and provide reports on the company’s financial status in a reliable and timely manner. internal controls should include both preventative and detective controls. the purpose of preventative controls is to stop problems and errors before they occur. detective controls identify problems after they have occurred. preventative controls are usually more effective at reducing problems, but they also tend to be more expensive. internal controls must be flexible to adjust for changes in laws and regulations in addition to adding new products or modifying current ones. companies must also do regular analyses to ensure that the benefits of implementing the controls are worth their costs. when concerned about paying unwarranted insurance claims which type of control would be useful?

Answers: 2

Business, 22.06.2019 06:40

As a finance manager at allsports communication, charlie worries about the firm's borrowing requirements for the upcoming year. he knows the benefit of estimating allsports' cash disbursements and short-term investment expectations. facing these concerns, a(n) would provide charlie with valuable information by providing a good estimation of whether the firm will need to do short-term borrowing. capital budget cash budget operating budget line item budget

Answers: 3

Business, 22.06.2019 19:30

Do a swot analysis for the business idea you chose in question 2 above. describe at least 2 strengths, 2 weaknesses, 2 opportunities, and 2 threats for that company idea.

Answers: 2

You know the right answer?

In addition to cash contributions to charity, Dean decided to donate shares of stock and a portrait...

Questions

Spanish, 03.10.2019 10:30

Physics, 03.10.2019 10:30

English, 03.10.2019 10:30

Mathematics, 03.10.2019 10:30

Health, 03.10.2019 10:30

Physics, 03.10.2019 10:30

History, 03.10.2019 10:30

Social Studies, 03.10.2019 10:30

Mathematics, 03.10.2019 10:30

Computers and Technology, 03.10.2019 10:30

Biology, 03.10.2019 10:30