Business, 26.02.2020 04:14 melaniem50

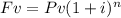

Suppose the U. S. Treasury offers to sell you a bond for $3,000. No payments will be made until the bond matures 10 years from now, at which time it will be redeemed for $5,000. What interest rate would you earn if you bought this bond at the offer price? (Hint: Be careful about the sign of cash flows because this problem is to solve for the interest rate.)

a. 3.82%

b. 4.25%

c. 4.72%

d. 5.24%

e. 5.77%

Answers: 2

Another question on Business

Business, 22.06.2019 15:00

(a) what do you think will happen if the price of non-gm crops continues to rise? why? (b) what will happen if the price of non-gm food drops? why?

Answers: 2

Business, 22.06.2019 19:00

The demand curve determines equilibrium price in a market. is a graphical representation of the relationship between price and quantity demanded. depicts the relationship between production costs and output. is a graphical representation of the relationship between price and quantity supplied.

Answers: 1

Business, 22.06.2019 20:20

Trade will take place: a. if the maximum that a consumer is willing and able to pay is less than the minimum price the producer is willing and able to accept for a good. b. if the maximum that a consumer is willing and able to pay is greater than the minimum price the producer is willing and able to accept for a good. c. only if the maximum that a consumer is willing and able to pay is equal to the minimum price the producer is willing and able to accept for a good. d. none of the above.

Answers: 3

Business, 22.06.2019 22:10

Asupermarket has been experiencing long lines during peak periods of the day. the problem is noticeably worse on certain days of the week, and the peak periods are sometimes different according to the day of the week. there are usually enough workers on the job to open all cash registers. the problem is knowing when to call some of the workers stocking shelves up to the front to work the checkout counters. how might decision models the supermarket? what data would be needed to develop these models?

Answers: 2

You know the right answer?

Suppose the U. S. Treasury offers to sell you a bond for $3,000. No payments will be made until the...

Questions

Mathematics, 18.01.2021 18:10

Engineering, 18.01.2021 18:10

Chemistry, 18.01.2021 18:10

Mathematics, 18.01.2021 18:10

Advanced Placement (AP), 18.01.2021 18:10

Advanced Placement (AP), 18.01.2021 18:20

Business, 18.01.2021 18:20

Mathematics, 18.01.2021 18:20

Mathematics, 18.01.2021 18:20

Mathematics, 18.01.2021 18:20

Mathematics, 18.01.2021 18:20

Mathematics, 18.01.2021 18:20

English, 18.01.2021 18:20

![\sqrt[10]{5/3}](/tpl/images/0524/5158/014bf.png) =1+i then we subtract both sides by 1 to solve for i

=1+i then we subtract both sides by 1 to solve for i