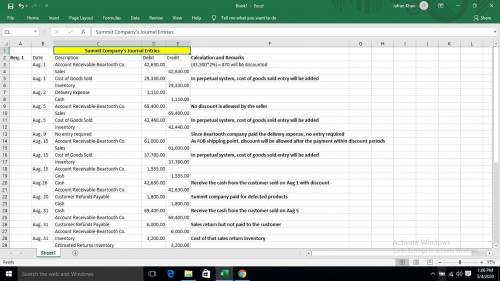

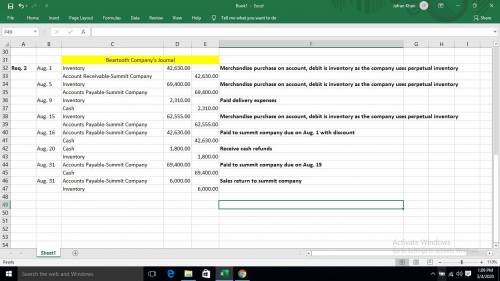

The following selected transactions were completed during August between Summit Co. and Beartooth Co.: Aug. 1 Summit Co. sold merchandise on account to Beartooth Co., $43,500, terms FOB destination, 2/15, n/eom. The cost of the merchandise sold was $29,330. 2 Summit Co. paid freight of $1,110 for delivery of merchandise sold to Beartooth Co. on August 1. 5 Summit Co. sold merchandise on account to Beartooth Co., $69,400, terms FOB shipping point, n/eom. The cost of the merchandise sold was $42,440. 9 Beartooth Co. paid freight of $2,310 on August 5 purchase from Summit Company. 15 Summit Co. sold merchandise on account to Beartooth Co., $61,000, terms FOB shipping point, 1/10, n/30. Summit Company paid freight of $1,555, which was added to the invoice. The cost of the merchandise sold was $37,780. 16 Beartooth Co. paid Summit Company for purchase of August 1. 20 Summit Company paid Beartooth Co. a refund of $1,800 for defective merchandise in the August 1 purchase. Beartooth Co. agreed to keep the merchandise. 25 Beartooth Co. paid Summit Company on account for purchase of August 15. 31 Summit Company granted a customer allowance (credit memo) to Beartooth Co. for $6,000 (invoiced amount) for merchandise that was returned from the August 1 purchase. The cost of the merchandise returned was $3,200. Required: Journalize the August transactions for (1) Summit Co. and (2) Beartooth Co. Refer to the Chart of Accounts of the appropriate company for exact wording of account titles.

Answers: 2

Another question on Business

Business, 22.06.2019 15:20

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

Business, 22.06.2019 17:40

Turrubiates corporation makes a product that uses a material with the following standards standard quantity 8.0 liters per unit standard price $2.50 per liter standard cost $20.00 per unit the company budgeted for production of 3,800 units in april, but actual production was 3,900 units. the company used 32,000 liters of direct material to produce this output. the company purchased 20,100 liters of the direct material at $2.6 per liter. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for april is:

Answers: 1

Business, 22.06.2019 18:50

Dominic is the founder of an innovative "impromptu catering" business that provides elegant, healthy party food and decorations on less than 24 hours' notice. the company has grown by over 150 percent in the past year. dominic credits some of the company's success to studying the strategies of prominent social entrepreneurs, such as wikipedia's jimmy wales. what can dominic do to exemplify the social entrepreneurship model?

Answers: 2

You know the right answer?

The following selected transactions were completed during August between Summit Co. and Beartooth Co...

Questions

Computers and Technology, 05.03.2021 19:30

Mathematics, 05.03.2021 19:30

Social Studies, 05.03.2021 19:30

Mathematics, 05.03.2021 19:30

Biology, 05.03.2021 19:30

Mathematics, 05.03.2021 19:30

Mathematics, 05.03.2021 19:30

Chemistry, 05.03.2021 19:30

Physics, 05.03.2021 19:30

Computers and Technology, 05.03.2021 19:30

Computers and Technology, 05.03.2021 19:30

Chemistry, 05.03.2021 19:30

Social Studies, 05.03.2021 19:30