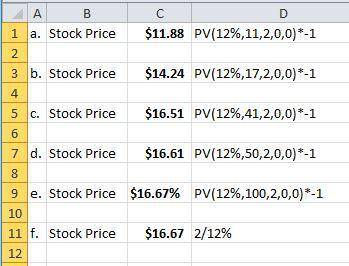

Singing Fish Fine Foods has a current annual cash dividend policy of $2.00. The price of the stock is set to yield a return of 12 %. What is the price of this stock if the dividend will be paid a. for 11 years? b. for 17 years? c. for 41 years? d. for 50 years? e. for 100 years? f. forever? a. What is the price of this stock if the dividend will be paid for 11 years?

Answers: 3

Another question on Business

Business, 22.06.2019 03:30

Used cars usually have options: higher depreciation rate than new cars lower financing costs than new cars lower insurance premiums than new cars lower maintenance costs than new cars

Answers: 1

Business, 22.06.2019 20:30

Contrast two economies that transitioned to capitalism and explain what factors affected the ease kf their transition as welas the “face” of capitalism that each has adopted

Answers: 2

Business, 22.06.2019 20:50

Happy foods and general grains both produce similar puffed rice breakfast cereals. for both companies, thecost of producing a box of cereal is 45 cents, and it is not possible for either company to lower their productioncosts any further. how can one company achieve a competitive advantage over the other?

Answers: 1

Business, 23.06.2019 03:00

If big macs were a durable good that could be costlessly transported between countries, which of the following would present an arbitrage opportunity? check all that apply. exporting big macs from argentina to the united states. exporting big macs from the united kingdom to poland. exporting big macs from switzerland to china

Answers: 1

You know the right answer?

Singing Fish Fine Foods has a current annual cash dividend policy of $2.00. The price of the stock i...

Questions

Mathematics, 12.02.2021 14:00

Biology, 12.02.2021 14:00

Mathematics, 12.02.2021 14:00

Mathematics, 12.02.2021 14:00

Arts, 12.02.2021 14:00

Physics, 12.02.2021 14:00

Mathematics, 12.02.2021 14:00

Chemistry, 12.02.2021 14:00

Mathematics, 12.02.2021 14:00

History, 12.02.2021 14:00

Chemistry, 12.02.2021 14:00