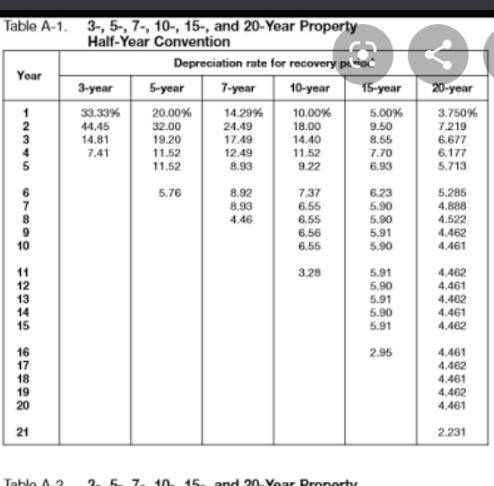

An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6,180,000 and will be sold for $1,380,000 at the end of the project. If the tax rate is 34 percent, what is the after tax salvage value of the asset?

Answers: 3

Another question on Business

Business, 21.06.2019 12:30

Jack should consider job enrichment when designing the new commercial cleaner jobs so that

Answers: 1

Business, 21.06.2019 14:40

Easel manufacturing budgeted fixed overhead costs of $ 1.50 per unit at an anticipated production level of 1 comma 350 units. in july easel incurred actual fixed overhead costs of $ 4 comma 700 and actually produced 1 comma 300 units. what is easel's fixed overhead budget variance for july?

Answers: 2

Business, 22.06.2019 22:30

The answer here, x=7, is not in the interval that you selected in the previous part. what is wrong with the work shown above?

Answers: 1

Business, 23.06.2019 13:40

Nicholas makes $2,000 per month. he spends $300 on credit card payments and $350 on an auto loan. what is his debt-to-income ratio? 17.5 percent 22 percent 2.7 percent 32.5 percent

Answers: 1

You know the right answer?

An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset...

Questions

Biology, 09.03.2021 23:40

Mathematics, 09.03.2021 23:40

History, 09.03.2021 23:40

Mathematics, 09.03.2021 23:40

Mathematics, 09.03.2021 23:40

Mathematics, 09.03.2021 23:40

Mathematics, 09.03.2021 23:40

Mathematics, 09.03.2021 23:40

Mathematics, 09.03.2021 23:40