Business, 27.02.2020 23:55 hannahmorgret7811

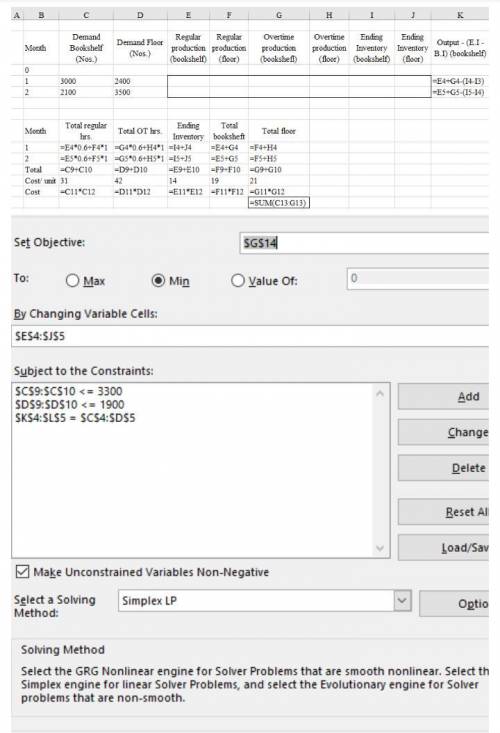

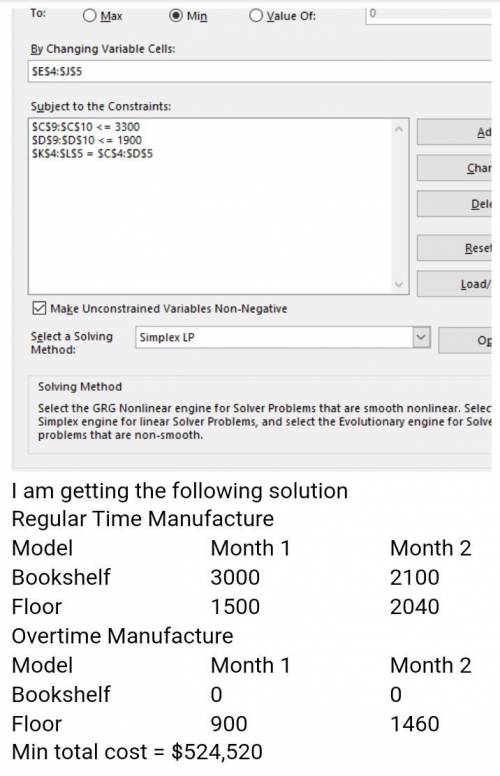

Greenville Cabinets received a contract to produce speaker cabinets for a major speaker manufacturer. The contract calls for the production of 5,100 bookshelf speakers and 5,900 floor speakers over the next two months, with the following delivery schedule: Model Month 1 Month 2 Bookshelf 3,000 2,100 Floor 2,400 3,500 Greenville estimates that the production time for each bookshelf model is 0.6 hour and the production time for each floor model is 1 hour. The raw material costs are $19 for each bookshelf model and $21 for each floor model. Labor costs are $31 per hour using regular production time and $42 using overtime. Greenville has up to 3,300 hours of regular production time available each month and up to 1,900 additional hours of overtime available each month. If production for either cabinet exceeds demand in month 1, the cabinets can be stored at a cost of $14 per cabinet. For each product, determine the number of units that should be manufactured each month on regular time and on overtime to minimize total production and storage costs. If required, round your answers to the nearest whole number. If an amount is zero, enter "0". Use a software package LINGO or Excel Solver.

Answers: 3

Another question on Business

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 09:30

What is the relationship among market segmentation, target markts, and consumer profiles?

Answers: 2

Business, 22.06.2019 11:50

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

You know the right answer?

Greenville Cabinets received a contract to produce speaker cabinets for a major speaker manufacturer...

Questions

Medicine, 16.10.2020 18:01

History, 16.10.2020 18:01

Mathematics, 16.10.2020 18:01

Mathematics, 16.10.2020 18:01

Mathematics, 16.10.2020 18:01

Geography, 16.10.2020 18:01

History, 16.10.2020 18:01

Mathematics, 16.10.2020 18:01

Computers and Technology, 16.10.2020 18:01

Mathematics, 16.10.2020 18:01

English, 16.10.2020 18:01