Business, 28.02.2020 00:20 janahiac09

Find each specified probability for the given scenario.

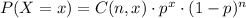

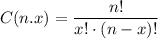

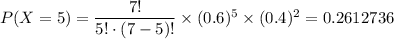

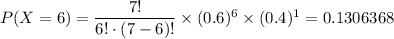

15. Suppose that the probability of Thad making a free throw in the championship basketball

game is 60%, and each throw is independent of his last throw. Assume that Thad attempts

seven free throws during the game.

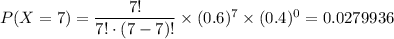

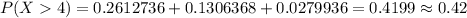

a. What is the probability that he will make more than four of his free throws?

b. What is the probability that he will make all of his free throws?

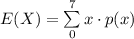

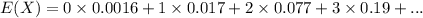

c. How many free throws should we expect Thad to make of the seven attempts during this

game?

Answers: 3

Another question on Business

Business, 21.06.2019 19:00

Minolta inc. is considering a project that has the following cash flow and wacc data. what is the project's mirr? note that a project's projected mirr can be less than the wacc (and even negative), in which case it will be rejected. wacc: 10.00% year 0 1 2 3 4 cash flows -$850 300 $320 $340 $360

Answers: 3

Business, 22.06.2019 18:00

Carlton industries is considering a new project that they plan to price at $74.00 per unit. the variable costs are estimated at $39.22 per unit and total fixed costs are estimated at $12,085. the initial investment required is $8,000 and the project has an estimated life of 4 years. the firm requires a return of 8 percent. ignore the effect of taxes. what is the degree of operating leverage at the financial break-even level of output?

Answers: 3

Business, 22.06.2019 22:00

On january 8, the end of the first weekly pay period of the year, regis company's payroll register showed that its employees earned $22,760 of office salaries and $70,840 of sales salaries. withholdings from the employees' salaries include fica social security taxes at the rate of 6.20%, fica medicare taxes at the rate of 1.45%, $13,260 of federal income taxes, $1,450 of medical insurance deductions, and $860 of union dues. no employee earned more than $7,000 in this first pay period. required: 1.1 calculate below the amounts for each of these four taxes of regis company. regis’s merit rating reduces its state unemployment tax rate to 3% of the first $7,000 paid to each employee. the federal unemployment tax rate is 0.60

Answers: 3

Business, 23.06.2019 02:00

Present values. the 2-year discount factor is .92. what is the present value of $1 to be received in year 2? what is the present value of $2,000? (lo5-2)

Answers: 3

You know the right answer?

Find each specified probability for the given scenario.

15. Suppose that the probability of Th...

15. Suppose that the probability of Th...

Questions

Mathematics, 11.12.2021 06:40

Mathematics, 11.12.2021 06:40

Spanish, 11.12.2021 06:40

Mathematics, 11.12.2021 06:40

Mathematics, 11.12.2021 06:40

Mathematics, 11.12.2021 06:40

Mathematics, 11.12.2021 06:40