Business, 28.02.2020 00:43 florenciaaxell4042

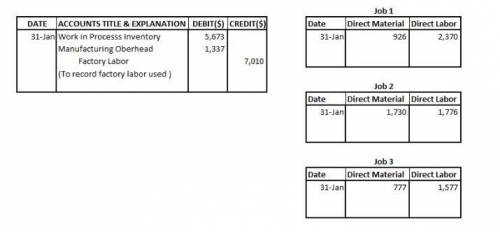

During January, its first month of operations, Knox Company accumulated the following manufacturing costs: raw materials $5, 310 on account, factory labor $7, 010 of which $5, 673 relates to factory wages payable and $1, 337 relates to payroll taxes payable, and utilities payable $2, 130. During January, time tickets show that the factory labor of $7, 010 was used as follows: Job 1 $2, 314, Job 2 $1, 733, Job 3 $1, 529, and general factory use $1, 434. Prepare a summary journal entry to record factory labor used. In January, Knox Company requisitions raw materials for production as follows: Job 1 $926, Job 2 $1, 730, Job 3 $777, and general factory use $701.

Answers: 2

Another question on Business

Business, 21.06.2019 13:30

How is a proportional tax different from a progressive tax? a. a proportional tax decreases with income level, but a progressive tax increases with income level. b. a proportional tax increases with income level, but a progressive tax decreases with income level. c. a proportional tax increases with income level, but a progressive tax is the same percentage for all. d. a proportional tax is the same percentage for all, but a progressive tax increases with income level.

Answers: 2

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

Business, 22.06.2019 20:00

In myanmar, six laborers, each making the equivalent of $ 2.50 per day, can produce 40 units per day. in china, ten laborers, each making the equivalent of $ 2.25 per day, can produce 48 units. in billings comma montana, two laborers, each making $ 60.00 per day, can make 102 units. based on labor cost per unit only, the most economical location to produce the item is china , with a labor cost per unit of $ . 05. (enter your response rounded to two decimal places.)

Answers: 3

Business, 22.06.2019 20:20

Levine inc., which produces a single product, has prepared the following standard cost sheet for one unit of the product. direct materials (9 pounds at $1.80 per pound) $16.20 direct labor (6 hours at $14.00 per hour) $84.00 during the month of april, the company manufactures 270 units and incurs the following actual costs. direct materials purchased and used (2,500 pounds) $5,000 direct labor (1,660 hours) $22,908 compute the total, price, and quantity variances for materials and labor.

Answers: 2

You know the right answer?

During January, its first month of operations, Knox Company accumulated the following manufacturing...

Questions

Physics, 15.01.2021 23:20

Spanish, 15.01.2021 23:20

Mathematics, 15.01.2021 23:20

Social Studies, 15.01.2021 23:20

Mathematics, 15.01.2021 23:20

Geography, 15.01.2021 23:20

Mathematics, 15.01.2021 23:20

Mathematics, 15.01.2021 23:20

Mathematics, 15.01.2021 23:20

Chemistry, 15.01.2021 23:20

Law, 15.01.2021 23:20

English, 15.01.2021 23:20