Business, 28.02.2020 03:54 abigailweeks10

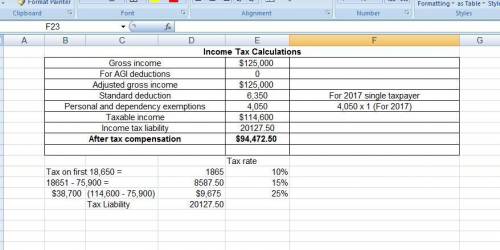

Rick, who is single, has been offered a position as a city landscape consultant. the position pays $125,000 in cash wages. assume Rick files single and is entitled to one personal exemption. Rick deducts the standard deduction instead of itemized deductions. (use the tax rate schedules.)

a. what is the amount of Rocks after-tax compensation (ignore payroll taxes )?( do not round intermediate calculations. round income tax liability and After-tax compensation to 2 decimal places. enter deductions as negative amounts)

1. Gross income

2. for AGI deductions

3. adjusted gross income

4. standard deduction

5. personal and dependency exemptions

6. taxable income

7. income tax liability

Answers: 2

Another question on Business

Business, 22.06.2019 01:20

Cindy recently played in a softball game in which she misplayed a ground ball for an error. later, in the same game, she made a great catch on a very difficult play. according to the self-serving bias, she would attribute her error to and her good catch to her

Answers: 1

Business, 22.06.2019 03:00

Fanning books buys books and magazines directly from publishers and distributes them to grocery stores. the wholesaler expects to purchase the following inventory: april may june required purchases (on account) $ 111,000 $ 131,000 $ 143,000 fanning books accountant prepared the following schedule of cash payments for inventory purchases. fanning books suppliers require that 85 percent of purchases on account be paid in the month of purchase; the remaining 15 percent are paid in the month following the month of purchase. required complete the schedule of cash payments for inventory purchases by filling in the missing amounts. determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter.

Answers: 2

Business, 22.06.2019 10:30

Zapper has beginning equity of $257,000, net income of $51,000, dividends of $40,000 and investments by stockholders of $6,000. its ending equity is

Answers: 2

Business, 22.06.2019 12:30

Consider a treasury bill with a rate of return of 5% and the following risky securities: security a: e(r) = .15; variance = .0400 security b: e(r) = .10; variance = .0225 security c: e(r) = .12; variance = .1000 security d: e(r) = .13; variance = .0625 the investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. the security the investor should choose as part of her complete portfolio to achieve the best cal would be a. security a b. security b c. security c d. security d

Answers: 3

You know the right answer?

Rick, who is single, has been offered a position as a city landscape consultant. the position pays $...

Questions

Mathematics, 17.12.2020 18:50

Mathematics, 17.12.2020 18:50

English, 17.12.2020 18:50

Arts, 17.12.2020 18:50

Computers and Technology, 17.12.2020 18:50

Mathematics, 17.12.2020 18:50

English, 17.12.2020 18:50

Mathematics, 17.12.2020 18:50

Mathematics, 17.12.2020 18:50

English, 17.12.2020 18:50