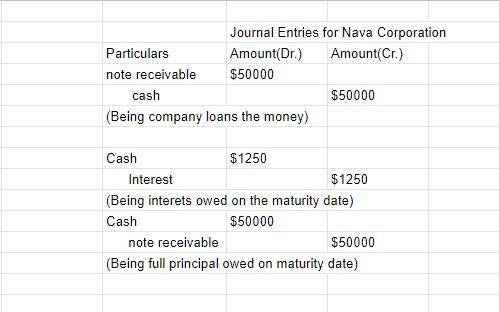

Nova Corporation hired a new product manager and agreed to provide her a $50,000 relocation loan on a six-month, 5 percent note. a. The company loans the money on January 1.b. The new employee pays Nova the interest owed on the maturity date. c. The new employee pays Nova the full principal owed on the maturity date. Prepare journal entries to record the above transactions for Nova Corporation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.)

Answers: 3

Another question on Business

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 21:50

Which three of the following expenses can student aid recover? -tuition -television -school supplies -parties and socializing -boarding/housing

Answers: 2

Business, 23.06.2019 08:30

In the supply-and-demand schedule shown above, the equilibrium price for cell phones is $25 $100 $200

Answers: 2

You know the right answer?

Nova Corporation hired a new product manager and agreed to provide her a $50,000 relocation loan on...

Questions

Health, 20.12.2021 22:40

Mathematics, 20.12.2021 22:40

Mathematics, 20.12.2021 22:40

Chemistry, 20.12.2021 22:40

Health, 20.12.2021 22:40

History, 20.12.2021 22:50

Mathematics, 20.12.2021 22:50

Mathematics, 20.12.2021 22:50

Mathematics, 20.12.2021 22:50

Mathematics, 20.12.2021 22:50

English, 20.12.2021 22:50

Mathematics, 20.12.2021 22:50