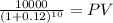

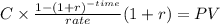

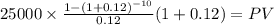

Kiddy Toy Corporation needs to acquire the use of a machine to be used in its manufacturing process. The machine needed is manufactured by Lollie Corp. The machine can be used for 10 years and then sold for $10,000 at the end of its useful life. Lollie has presented Kiddy with the following options:1. Buy machine. The machine could be purchased for $160,000 in cash. All insurance costs, which approximate $5,000 per year, would be paid by Kiddy2. Lease machine. The machine could be leased for a 10-year period for an annual lease payment of $25,000 with the first payment due immediately. All insurance costs will be paid for by the Lollie Corp. and the machine will revert back to Lollie at the end of the 10-year period. Required:Assuming that a 12% interest rate properly reflects the time value of money in this situation and that all maintenance and insurance costs are paid at the end of each year, determine which option Kiddy should choose. Ignore income tax considerations.

Answers: 2

Another question on Business

Business, 22.06.2019 01:50

Amanda rice has just arranged to purchase a $640,000 vacation home in the bahamas with a 20 percent down payment. the mortgage has a 7 percent apr compounded monthly and calls for equal monthly payments over the next 30 years. her first payment will be due one month from now. however, the mortgage has an eight-year balloon payment, meaning that the balance of the loan must be paid off at the end of year 8. there were no other transaction costs or finance charges. how much will amanda’s balloon payment be in eight years

Answers: 3

Business, 22.06.2019 12:10

Which of the following is not part of the mission statement of the department of homeland security? lead the unified national effort to secure america protect against and respond to threats and hazards to the nation ensure safe and secure borders coordinate intelligence operations against terrorists in other countries

Answers: 1

Business, 22.06.2019 19:30

Kirnon clinic uses client-visits as its measure of activity. during july, the clinic budgeted for 3,250 client-visits, but its actual level of activity was 3,160 client-visits. the clinic has provided the following data concerning the formulas to be used in its budgeting: fixed element per month variable element per client-visitrevenue - $ 39.10personnel expenses $ 35,100 $ 10.30medical supplies 1,100 7.10occupancy expenses 8,100 1.10administrative expenses 5,100 0.20total expenses $ 49,400 $ 18.70the activity variance for net operating income in july would be closest to:

Answers: 1

Business, 22.06.2019 19:40

Which term describes an alternative to car buying where monthly payments are paid for a specific period of time, after which the vehicle is returned to the dealership or bought? a. car financing b. car maintenance c. car leasing d. car ownership

Answers: 3

You know the right answer?

Kiddy Toy Corporation needs to acquire the use of a machine to be used in its manufacturing process....

Questions

Biology, 12.12.2019 21:31

Computers and Technology, 12.12.2019 21:31

Mathematics, 12.12.2019 21:31