Business, 02.03.2020 17:29 dylanolmeda9

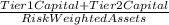

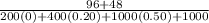

A bank has $200 million in assets in the 0 percent risk-weight category. It has $400 million in assets in the 20 percent risk-weight category. It has $1,000 million in assets in the 50 percent risk-weight category and has $1,000 million in assets in the 100 percent risk-weight category. This bank has $96 million in Tier 1 capital and $48 million in Tier 2 capital. What is this bank's ratio of total capital to risk assets?

Answers: 2

Another question on Business

Business, 21.06.2019 17:40

Assume the government imposes a $2.25 tax on suppliers, which results in a shift of the supply curve from s1 to s2. the price the seller receives for the product after paying the tax is

Answers: 2

Business, 22.06.2019 14:30

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 22.06.2019 16:20

The following information relates to the pina company. date ending inventory price (end-of-year prices) index december 31, 2013 $73,700 100 december 31, 2014 100,092 114 december 31, 2015 107,856 126 december 31, 2016 123,009 131 december 31, 2017 113,288 136 use the dollar-value lifo method to compute the ending inventory for pina company for 2013 through 2017.

Answers: 1

Business, 22.06.2019 18:00

What would not cause duff beer’s production possibilities curve to expand in the short run? a. improved manufacturing technology b. additional resources c. increased demand

Answers: 1

You know the right answer?

A bank has $200 million in assets in the 0 percent risk-weight category. It has $400 million in asse...

Questions

English, 17.12.2020 14:00

Biology, 17.12.2020 14:00

Arts, 17.12.2020 14:00

Mathematics, 17.12.2020 14:00

History, 17.12.2020 14:00

Mathematics, 17.12.2020 14:00

Social Studies, 17.12.2020 14:00

Social Studies, 17.12.2020 14:00

History, 17.12.2020 14:00

Social Studies, 17.12.2020 14:00

SAT, 17.12.2020 14:00

Biology, 17.12.2020 14:00

Mathematics, 17.12.2020 14:00