Business, 02.03.2020 19:04 jasmelynn16

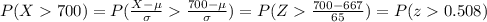

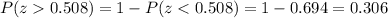

G Credit card applicants have an average credit rating score of 667. Assume the distribution of credit scores is Normal with a standard deviationof 65. Use this information to answer the problems below. Write probability statementsand show all of your work.70. What is the probability that a single applicant for a credit card will have a credit rating score above 700?

Answers: 1

Another question on Business

Business, 22.06.2019 11:50

True or flase? a. new technological developments can us adapt to depleting sources of natural resources. b. research and development funds from the government to private industry never pay off for the country as a whole; they only increase the profits of rich corporations. c. in order for fledgling industries in poor nations to thrive, they must receive protection from foreign trade. d. countries with few natural resources will always be poor. e. as long as real gdp (gross domestic product) grows at a slower rate than the population, per capita real gdp increases.

Answers: 2

Business, 22.06.2019 23:00

Doogan corporation makes a product with the following standard costs: standard quantity or hours standard price or rate direct materials 2.0 grams $ 7.00 per gram direct labor 1.6 hours $ 12.00 per hour variable overhead 1.6 hours $ 6.00 per hour the company produced 5,000 units in january using 10,340 grams of direct material and 2,320 direct labor-hours. during the month, the company purchased 10,910 grams of the direct material at $7.30 per gram. the actual direct labor rate was $12.85 per hour and the actual variable overhead rate was $5.80 per hour. the company applies variable overhead on the basis of direct labor-hours. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for january is:

Answers: 1

Business, 22.06.2019 23:30

Rate of return douglas keel, a financial analyst for orange industries, wishes to estimate the rate of return for two similar-risk investments, x and y. douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. a year earlier, investment x had a market value of $27 comma 000; and investment y had a market value of $46 comma 000. during the year, investment x generated cash flow of $2 comma 025 and investment y generated cash flow of $ 6 comma 770. the current market values of investments x and y are $28 comma 582 and $46 comma 000, respectively. a. calculate the expected rate of return on investments x and y using the most recent year's data. b. assuming that the two investments are equally risky, which one should douglas recommend? why?

Answers: 1

Business, 23.06.2019 01:00

Bob, an employee at machina corp., is well known among his colleagues because of his temper and impatience. during a heated argument with one of his supervisors, he reacts with hostility. bob's manager calls him in for a discussion and listens to what he has to say about the incident, while treating him with dignity and respect. this scenario can be best categorized as one that used

Answers: 3

You know the right answer?

G Credit card applicants have an average credit rating score of 667. Assume the distribution of cred...

Questions

Mathematics, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

History, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

Biology, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

English, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

English, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

Mathematics, 25.10.2021 09:10

Biology, 25.10.2021 09:10

and

and