Business, 03.03.2020 21:59 laura52677

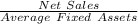

Company A uses an accelerated depreciation method while Company B uses the straight-line method. All other things being equal, during the first few years of the asset's use, Company B will show which of the following compared to Company A?

a. A smaller fixed asset turnover ratio and a larger gain on asset disposal.

b. A larger fixed asset turnover ratio and a smaller gain on asset disposal.

c. A smaller fixed asset turnover ratio and a smaller gain on asset disposal.

d. A larger fixed asset turnover ratio and a larger gain on asset disposal.

Answers: 1

Another question on Business

Business, 22.06.2019 11:10

Use the information below to answer the following question. the boxwood company sells blankets for $60 each. the following was taken from the inventory records during may. the company had no beginning inventory on may 1. date blankets units cost may 3 purchase 5 $20 10 sale 3 17 purchase 10 $24 20 sale 6 23 sale 3 30 purchase 10 $30 assuming that the company uses the perpetual inventory system, determine the gross profit for the month of may using the lifo cost method.

Answers: 1

Business, 22.06.2019 11:20

In 2000, campbell soup company launched an ad campaign that showed prepubescent boys offering soup to prepubescent girls. the girls declined because they were concerned about their calorie intake. the boys explained that “lots of campbell’s soups are low in calories,” which made them ok for the girls to eat. the ads were pulled after parents expressed concern. why were parents worried? i

Answers: 2

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

You know the right answer?

Company A uses an accelerated depreciation method while Company B uses the straight-line method. All...

Questions

Computers and Technology, 11.07.2019 10:00

History, 11.07.2019 10:00

Mathematics, 11.07.2019 10:00

History, 11.07.2019 10:00

History, 11.07.2019 10:00

History, 11.07.2019 10:00

Physics, 11.07.2019 10:00

Business, 11.07.2019 10:00

History, 11.07.2019 10:00

Mathematics, 11.07.2019 10:00

History, 11.07.2019 10:00

History, 11.07.2019 10:00