Business, 04.03.2020 04:19 brainewashed11123

The Best Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here. The corporate tax rate is 40 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project.

Year 0 Year 1 Year 2 Year 3 Year 4

Investment $ 43,000

Sales revenue $ 22,000 $ 22,500 $ 23,000 $ 20,000

Operating costs 4,600 4,700 4,800 4,000

Depreciation 10,750 10,750 10,750 10,750

Net working capital spending 490 540 590 490 ?

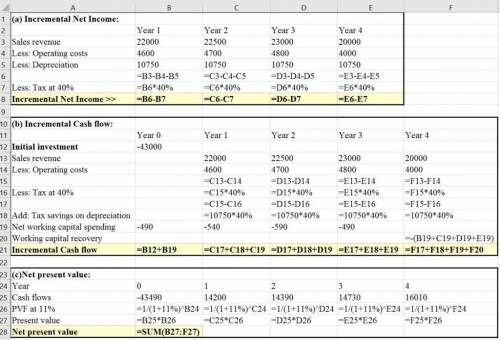

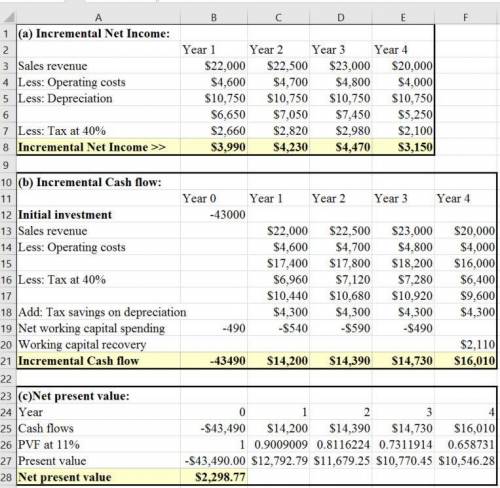

Compute the incremental net income of the investment for each year. (Do not round intermediate calculations.)

Year 1 Year 2 Year 3 Year 4

Net income $ $ $ $

b.

Compute the incremental cash flows of the investment for each year. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.)

Year 0 Year 1 Year 2 Year 3 Year 4

Cash flow $ $ $ $ $

c.

Suppose the appropriate discount rate is 11 percent. What is the NPV of the project? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e. g., 32.16))

NPV $

Answers: 3

Another question on Business

Business, 22.06.2019 01:00

Who is better at multi-tasking? in business, employees are often asked to perform a complex task when their atten-tion is divided (i.e., multi-tasking). human factors (may 2014) published a study designed to determine whether video game players are better than non–video game play-ers at multi-tasking. each in a sample of 60 college stu-dents was classified as a video game player or a non-player. participants entered a street crossing simulator and were asked to cross a busy street at an unsigned intersec-tion. the simulator was designed to have cars traveling at various high rates of speed in both directions. during the crossing, the students also performed a memory task as a distraction. two variables were measured for each student: (1) a street crossing performance score (measured out of 100 points) and (2) a memory task score (measured out of 20 points). the researchers found no differences in either the street crossing performance or memory task score of video game players and non-gamers. “these results,” say the researchers, “suggest that action video game players [and non-gamers] are equally susceptible to the costs of dividing attention in a complex task”

Answers: 1

Business, 22.06.2019 01:00

You are the manager in charge of global operations at bankglobal – a large commercial bank that operates in a number of countries around the world. you must decide whether or not to launch a new advertising campaign in the u.s. market. your accounting department has provided the accompanying statement, which summarizes the financial impact of the advertising campaign on u.s. operations. in addition, you recently received a call from a colleague in charge of foreign operations, and she indicated that her unit would lose $8 million if the u.s. advertising campaign were launched. your goal is to maximize bankglobal’s value. should you launch the new campaign? explain. pre-advertising campaign post-advertising campaign total revenues $18,610,900 $31,980,200 variable cost tv airtime 5,750,350 8,610,400 ad development labor 1,960,580 3,102,450 total variable costs 7,710,930 11,712,850 direct fixed cost depreciation – computer equipment 1,500,000 1,500,000 total direct fixed cost 1,500,000 1,500,000 indirect fixed cost managerial salaries 8,458,100 8,458,100 office supplies 2,003,500 2,003,500 total indirect fixed cost $10,461,600 $10,461,600

Answers: 2

Business, 22.06.2019 19:30

He moto hotel opened for business on may 1, 2017. here is its trial balance before adjustment on may 31. moto hotel trial balance may 31, 2017 debit credit cash $ 2,283 supplies 2,600 prepaid insurance 1,800 land 14,783 buildings 72,400 equipment 16,800 accounts payable $ 4,483 unearned rent revenue 3,300 mortgage payable 38,400 common stock 59,783 rent revenue 9,000 salaries and wages expense 3,000 utilities expense 800 advertising expense 500 $114,966 $114,966 other data: 1. insurance expires at the rate of $360 per month. 2. a count of supplies shows $1,050 of unused supplies on may 31. 3. (a) annual depreciation is $2,760 on the building. (b) annual depreciation is $2,160 on equipment. 4. the mortgage interest rate is 5%. (the mortgage was taken out on may 1.) 5. unearned rent of $2,580 has been earned. 6. salaries of $810 are accrued and unpaid at may 31

Answers: 2

You know the right answer?

The Best Manufacturing Company is considering a new investment. Financial projections for the invest...

Questions

Mathematics, 17.12.2020 22:10

Mathematics, 17.12.2020 22:10

History, 17.12.2020 22:10

Mathematics, 17.12.2020 22:10

History, 17.12.2020 22:10

Mathematics, 17.12.2020 22:10

Mathematics, 17.12.2020 22:10

Chemistry, 17.12.2020 22:10

Mathematics, 17.12.2020 22:10

Mathematics, 17.12.2020 22:10