Business, 04.03.2020 17:00 Oliviapuffinburger33

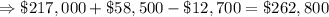

The Don't Tread on Me Tire Company had retained earnings at December 31, 2015 of $217,000. During 2016, the company had revenues of $417,000 and expenses of $358,500, and the company declared and paid dividends of $12,700. Retained earnings on the balance sheet as of December 31, 2016 will be.

a. $275,500.

b. $45,800.

c. $262,800.

d. $321,300

Answers: 1

Another question on Business

Business, 22.06.2019 23:30

As a result of a thorough physical inventory, waterway company determined that it had inventory worth $320200 at december 31, 2020. this count did not take into consideration the following facts: walker consignment currently has goods worth $47400 on its sales floor that belong to waterway but are being sold on consignment by walker. the selling price of these goods is $75900. waterway purchased $21900 of goods that were shipped on december 27, fob destination, that will be received by waterway on january 3. determine the correct amount of inventory that waterway should report.

Answers: 2

Business, 23.06.2019 00:40

Mesa company produces wooden rocking chairs. the company has two production departments, cutting and assembly. the wood is cut and sanded in cutting and then transferred to assembly to be assembled and painted. from assembly, the chairs are transferred to finished goods inventory and then are sold.mesa has compiled the following information for the month of february: cutting department assemblydepartmentdirect materials $ 73,000 $ 13,000direct labor 73,000 108,000applied manufacturing overhead 159,000 171,000cost of goods completed and transferred out 233,000 255,000required: 1, 2, 3, & 4. prepare journal entries for the transactions in the cutting and assembly departments of mesa company. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field.)

Answers: 3

Business, 23.06.2019 17:30

The ledger of laurie rental agency on march 31 of the current year includes the following selected accounts before adjusting entries have been prepared. debit credit prepaid insurance $ 5,400 supplies $ 4,500 equipment 40,000 accumulated depreciation—equipment $12,600 notes payable 25,000 unearned rent revenue 11,100 rent revenue 90,000 interest expense –0– salaries and wages expense 20,000 an analysis of the accounts shows the following. 1. the equipment depreciates $600 per month. 2. two-thirds of the unearned rent revenue was earned during the quarter. 3. the note payable is dated january 1 and bears 12% interest. 4. supplies on hand total $800. 5. the insurance policy is a two-year policy dated january 1. instructions: a. prepare the adjusting entries at march 31, assuming that adjusting entries are made quarterly. additional accounts are: depreciation expense, insurance expense, interest payable, and supplies expense. b. compute the ending balances for prepaid insurance, unearned rent revenue, and rent revenue, and indicate in which financial statement those items will be reported.

Answers: 1

You know the right answer?

The Don't Tread on Me Tire Company had retained earnings at December 31, 2015 of $217,000. During 20...

Questions

Mathematics, 16.11.2020 22:10

Mathematics, 16.11.2020 22:10

Mathematics, 16.11.2020 22:10

Mathematics, 16.11.2020 22:10

Advanced Placement (AP), 16.11.2020 22:10

Mathematics, 16.11.2020 22:10

Mathematics, 16.11.2020 22:10

English, 16.11.2020 22:10

Mathematics, 16.11.2020 22:10

Social Studies, 16.11.2020 22:10

Mathematics, 16.11.2020 22:10