Business, 07.03.2020 00:06 dogeking12

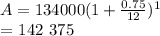

Sheffield Corp. uses the composite method and its composite rate is 7.5% per year, what entry should it make when plant assets that originally cost $134000?

Answers: 3

Another question on Business

Business, 22.06.2019 10:10

Rats that received electric shocks were unlikely to develop ulcers if the

Answers: 1

Business, 22.06.2019 22:20

Which of the following is correct? a. a tax burden falls more heavily on the side of the market that is more elastic.b. a tax burden falls more heavily on the side of the market that is less elastic.c. a tax burden falls more heavily on the side of the market that is closer to unit elastic.d. a tax burden is distributed independently of the relative elasticities of supply and demand.

Answers: 1

Business, 22.06.2019 23:30

Sole proprietorships produce more goods and services than does any other form of business organization.

Answers: 2

Business, 23.06.2019 00:30

Three years ago, the city of recker committed to build a park and music venue by the river. it was expected to cost $2.5 million and be paid for from an additional meals tax in the community. the residents pushed back. local restaurants suffered as people ate out less or patronized restaurants in neighboring communities. the project has stalled, but the town council kept pushing it on. this spring, a flood devastated the venue. the town council appears to have suffered from bias

Answers: 3

You know the right answer?

Sheffield Corp. uses the composite method and its composite rate is 7.5% per year, what entry should...

Questions

Computers and Technology, 01.02.2020 00:42

History, 01.02.2020 00:42

History, 01.02.2020 00:42

History, 01.02.2020 00:42

Spanish, 01.02.2020 00:42

English, 01.02.2020 00:42

History, 01.02.2020 00:42

Mathematics, 01.02.2020 00:42

Social Studies, 01.02.2020 00:42

= interest rate

= interest rate