Anne Cleves Company reported the following amounts in the stockholders’ equity section of its December 31, 2013, balance sheet. Preferred stock, 11%, $100 par (10,000 shares authorized, 2,280 shares issued) $228,000 Common stock, $5 par (127,550 shares authorized, 25,510 shares issued) 127,550 Additional paid-in capital 134,400 Retained earnings 478,700 Total $968,650 During 2014, Cleves took part in the following transactions concerning stockholders’ equity.

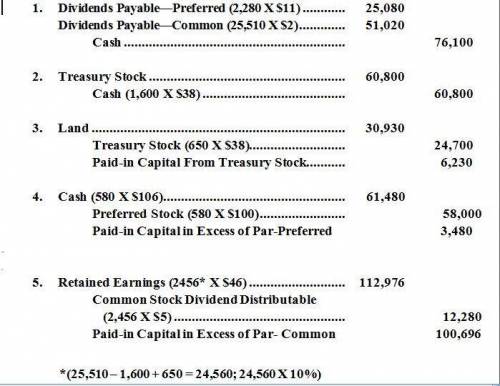

1. Paid the annual 2013 $11 per share dividend on preferred stock and a $2 per share dividend on common stock. These dividends had been declared on December 31, 2013.

2. Purchased 1,600 shares of its own outstanding common stock for $38 per share. Cleves uses the cost method.

3. Reissued 650 treasury shares for land valued at $30,930.

4. Issued 580 shares of preferred stock at $106 per share.

5. Declared a 10% stock dividend on the outstanding common stock when the stock is selling for $46 per share.

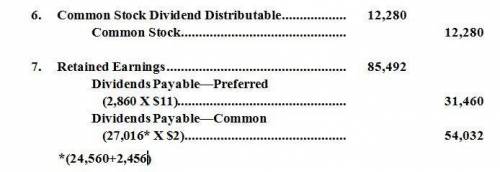

6. Issued the stock dividend.

7. Declared the annual 2014 $11 per share dividend on preferred stock and the $2 per share dividend on common stock. These dividends are payable in 2015.

(a) Prepare journal entries to record the transactions described above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

(b) Prepare the December 31, 2014, stockholders’ equity section. Assume 2014 net income was $334,600. (Enter account name only .Do not provide any descriptive information.)

Answers: 1

Another question on Business

Business, 22.06.2019 14:30

crow design, inc. is a web site design and consulting firm. the firm uses a job order costing system in which each client is a different job. crow design assigns direct labor, licensing costs, and travel costs directly to each job. it allocates indirect costs to jobs based on a predetermined overhead allocation rate, computed as a percentage of direct labor costs. direct labor hours (professional) 6,250 hours direct labor costs ($1,800,000 support staff salaries ,000 computer ,000 office ,000 office ,000 in november 2012, crow design served several clients. records for two clients appear here: delicious treats mesilla chocolates direct labor 700 hours 100 hours software licensing $ 4,000 $400 travel costs 8,000 1. compute crow design’s direct labor rate and its predetermined indirect cost allocation rate for 2012. 2. compute the total cost of each job. 3. if simone wants to earn profits equal to 50% of service revenue, how much (what fee) should she charge each of these two clients? 4. why does crow design assign costs to jobs?

Answers: 2

Business, 22.06.2019 16:00

In microeconomics, the point at which supply and demand meet is called the blank price

Answers: 3

Business, 23.06.2019 00:30

In a recent annual report, apple computer reported the following in one of its disclosure notes: "warranty expense: the company provides currently for the estimated cost for product warranties at the time the related revenue is recognized." this note exemplifies apple's use of: (a) conservatism.(b) matching. (c) realization principle. (d) economic entity.

Answers: 2

Business, 23.06.2019 03:10

He cheyenne hotel in big sky, montana, has accumulated records of the total electrical costs of the hotel and the number of occupancy-days over the last year. an occupancy-day represents a room rented out for one day. the hotel's business is highly seasonal, with peaks occurring during the ski season and in the summer. month occupancy- days electrical costs january 1,736 $ 4,127 february 1,904 $ 4,207 march 2,356 $ 5,083 april 960 $ 2,857 may 360 $ 1,871 june 744 $ 2,696 july 2,108 $ 4,670 august 2,406 $ 5,148 september 840 $ 2,691 october 124 $ 1,588 november 720 $ 2,454 december 1,364 $ 3,529 required: 1. using the high-low method, estimate the fixed cost of electricity per month and the variable cost of electricity per occupancy-day. (do not round your intermediate calculations. round your variable cost answer to 2 decimal places and fixed cost element answer to nearest whole dollar amount) 2. what other factors other than occupancy-days are likely to affect the variation in electrical costs from month to month? (you may select more than one answer. single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) seasonal factors like winter or summer. systematic factors like guests, switching off fans and lights. number of days present in a month. fixed salary paid to hotel receptionist. income taxes paid on hotel income.

Answers: 2

You know the right answer?

Anne Cleves Company reported the following amounts in the stockholders’ equity section of its Decemb...

Questions

Mathematics, 25.04.2021 14:00

Biology, 25.04.2021 14:00

Chemistry, 25.04.2021 14:00

Chemistry, 25.04.2021 14:00

Social Studies, 25.04.2021 14:00

English, 25.04.2021 14:00

Physics, 25.04.2021 14:00

Biology, 25.04.2021 14:00

Chemistry, 25.04.2021 14:00

History, 25.04.2021 14:00

Mathematics, 25.04.2021 14:00

World Languages, 25.04.2021 14:00