Business, 07.03.2020 05:17 puppylover72

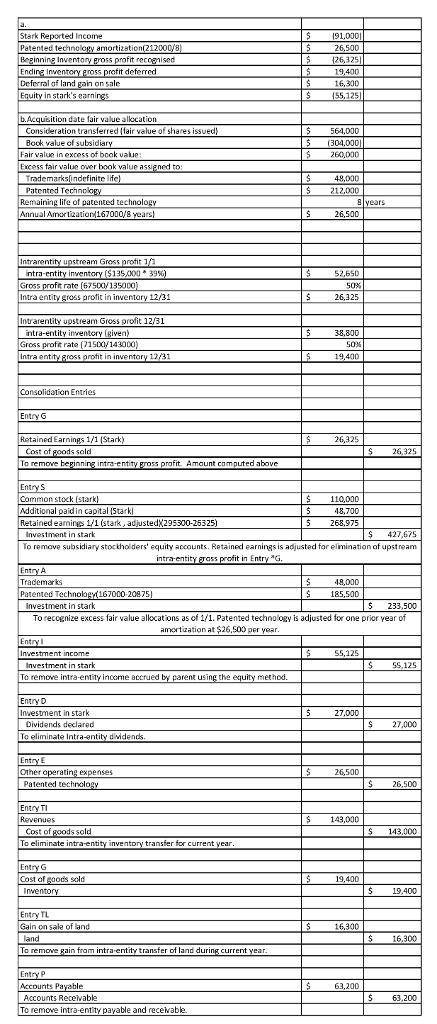

On January 1, 2017, Panther, Inc., issued securities with a total fair value of $564,000 for 100 percent of Stark Corporation's outstanding ownership shares. Stark has long supplied inventory to Panther. The companies expect to achieve synergies with production scheduling and product development with this combination.

Although Stark's book value at the acquisition date was $304,000, the fair value of its trademarks was assessed to be $48,000 more than their carrying amounts. Additionally, Stark's patented technology was undervalued in its accounting records by $212,000. The trademarks were considered to have indefinite lives, and the estimated remaining life of the patented technology was eight years.

In 2017, Stark sold Panther inventory costing $67,500 for $135,000. As of December 31, 2017, Panther had resold 61 percent of this inventory. In 2018, Panther bought from Stark $143,000 of inventory that had an original cost of $71,500. At the end of 2018, Panther held $38,800 (transfer price) of inventory acquired from Stark, all from its 2018 purchases.

During 2018, Panther sold Stark a parcel of land for $89,900 and recorded a gain of $16,300 on the sale. Stark still owes Panther $63,200 (current liability) related to the land sale.

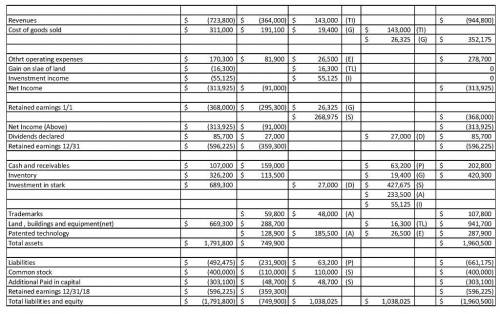

At the end of 2018, Panther and Stark prepared the following statements in preparation for consolidation.

Panther, Inc. Stark Corporation

Revenues $ (723,800 ) $ (364,000 )

Cost of goods sold 311,000 191,100

Other operating expenses 170,300 81,900

Gain on sale of land (16,300 ) 0

Equity in Stark's earnings (55,125 ) 0

Net income $ (313,925 ) $ (91,000 )

Retained earnings 1/1/18 $ (368,000 ) $ (295,300 )

Net income (313,925 ) (91,000 )

Dividends declared 85,700 27,000

Retained earnings 12/31/18 $ (596,225 ) $ (359,300 )

Cash and receivables $ 107,000 $ 159,000

Inventory 326,200 113,500

Investment in Stark 689,300 0

Trademarks 0 59,800

Land, buildings, and equip. (net) 669,300 288,700

Patented technology 0 128,900

Total assets $ 1,791,800 $ 749,900

Liabilities $ (492,475 ) $ (231,900 )

Common stock (400,000 ) (110,000 )

Additional paid-in capital (303,100 ) (48,700 )

Retained earnings 12/31/18 (596,225 ) (359,300 )

Total liabilities and equity $ (1,791,800 ) $ (749,900 )

Show how Panther computed its $55,125 equity in Stark's earnings balance.

Prepare a 2018 consolidated worksheet for Panther and Stark.

Answers: 3

Another question on Business

Business, 21.06.2019 20:50

Which of the following statements is not correct? 1) trade allows for specialization. 2) trade has the potential to benefit all nations. 3) trade allows nations to consume outside of their production possibilities curves. 4) absolute advantage is the driving force of specialization.

Answers: 3

Business, 21.06.2019 23:30

Which term refers to the cost that motivates an economic decision

Answers: 1

Business, 22.06.2019 00:30

Salty sensations snacks company manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. the company has budgeted the following costs for the upcoming period: 1 factory depreciation $33,782.00 2 indirect labor 84,456.00 3 factory electricity 8,446.00 4 indirect materials 40,356.00 5 selling expenses 26,900.00 6 administrative expenses 17,200.00 7 total costs $211,140.00 factory overhead is allocated to the three products on the basis of processing hours. the products had the following production budget and processing hours per case: budgeted volume (cases) processing hours per case tortilla chips 3,600 0.25 potato chips 5,300 0.11 pretzels 2,300 0.49 total 11,200 required: a. determine the single plantwide factory overhead rate.* b. use the factory overhead rate in (a) to determine the amount of total and per-case factory overhead allocated to each of the three products under generally accepted accounting principles. refer to the amount descriptions list provided for the exact wording of the answer choices for text entries.* * if required, round your answers to the nearest cen

Answers: 1

Business, 22.06.2019 01:00

Granby foods' (gf) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. the yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. the company has 10 million shares of stock, and the stock has a book value per share of $5.00. the current stock price is $20.00 per share, and stockholders' required rate of return, r s, is 12.25%. the company recently decided that its target capital structure should have 35% debt, with the balance being common equity. the tax rate is 40%. calculate waccs based on book, market, and target capital structures. what is the sum of these three waccs?

Answers: 3

You know the right answer?

On January 1, 2017, Panther, Inc., issued securities with a total fair value of $564,000 for 100 per...

Questions

Mathematics, 31.03.2021 01:10

Mathematics, 31.03.2021 01:10

Mathematics, 31.03.2021 01:10

Business, 31.03.2021 01:10

Mathematics, 31.03.2021 01:10

Mathematics, 31.03.2021 01:10

Mathematics, 31.03.2021 01:10

Mathematics, 31.03.2021 01:10

Mathematics, 31.03.2021 01:10

Mathematics, 31.03.2021 01:10

Mathematics, 31.03.2021 01:10