Business, 07.03.2020 04:57 netflixacc0107

A lease agreement that qualifies as a finance lease calls for annual lease payments of $10,000 over a five-year lease term (also the asset’s useful life), with the first payment at January 1, 2016, the beginning of the lease. The interest rate is 4%. The lessor’s fiscal year is the calendar year. The lessor manufactured this asset at a cost of $30,000. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

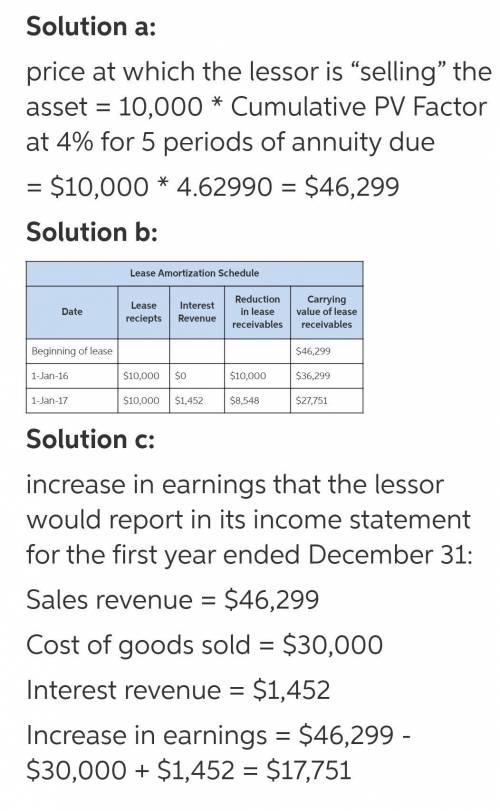

a. Determine the price at which the lessor is "selling" the asset (present value of the lease payments).

b. Create a partial amortization schedule through the second payment on January 1, 2017.

c. What would be the increase in earnings that the lessor would report in its income statement for the first year ended December 31 (ignore taxes)?

Answers: 1

Another question on Business

Business, 22.06.2019 12:30

Consider a treasury bill with a rate of return of 5% and the following risky securities: security a: e(r) = .15; variance = .0400 security b: e(r) = .10; variance = .0225 security c: e(r) = .12; variance = .1000 security d: e(r) = .13; variance = .0625 the investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. the security the investor should choose as part of her complete portfolio to achieve the best cal would be a. security a b. security b c. security c d. security d

Answers: 3

Business, 22.06.2019 20:20

Fractional reserve banking which of the following statements about fractional reserve banking are correct? check all that apply. fractional reserve banking allows banks to create money through the lending process. fractional reserve banking does not allow banks to hold excess reserves. fractional reserve banking allows banks to create additional wealth by lending some reserves. fractional reserve banking relies on everyone not withdrawing their money at the same time.

Answers: 2

Business, 22.06.2019 21:50

Q3. loral corporation manufactures parts for an aircraft company. it uses a computerized numerical controlled (cnc) machining center to produce a specific part that has a design (nominal) target of 1.275 inches with tolerances of ± 0.020 inch. the cnc process that manufactures these parts has a mean of 1.285 inches and a standard deviation of 0.005 inch. compute the process capability ratio and process capability index, and comment on the overall capability of the process to meet the design specifications.

Answers: 1

Business, 23.06.2019 01:30

Akika corporation started as a small firm and has grown substantially in the past decade. its interests span from electronics to real estate and aviation. akika's board of directors have now decided to create independent business units for and categorize the actions performed under each domain. each business unit will have distinct roles and responsibilities. which of the 14 principles of fayol does this exemplify?

Answers: 3

You know the right answer?

A lease agreement that qualifies as a finance lease calls for annual lease payments of $10,000 over...

Questions

Biology, 07.06.2021 18:30

Social Studies, 07.06.2021 18:30

Chemistry, 07.06.2021 18:30

Mathematics, 07.06.2021 18:30

Biology, 07.06.2021 18:30

Mathematics, 07.06.2021 18:30

Mathematics, 07.06.2021 18:30

Biology, 07.06.2021 18:30

Mathematics, 07.06.2021 18:30

Biology, 07.06.2021 18:30