Business, 07.03.2020 04:55 anonymous176

Assume that you manage a risky portfolio with an expected rate of return of 16% and a standard deviation of 32%. The T-bill rate is 5%. Your client chooses to invest 80% of a portfolio in your fund and 20% in a T-bill money market fund.

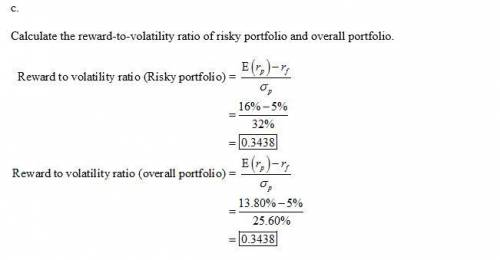

a. What is the expected return and standard deviation of your client's portfolio? (Round your answers to 2 decimal places.)

Expected return % per year

Standard deviation % per year

b. Suppose your risky portfolio includes the following investments in the given proportions:

Stock A 28%

Stock B 34%

Stock C 38%

What are the investment proportions of your client’s overall portfolio, including the position in T-bills? (Round your answers to 2 decimal places.)

Security Investment

Proportions

T-Bills %

Stock A %

Stock B %

Stock C %

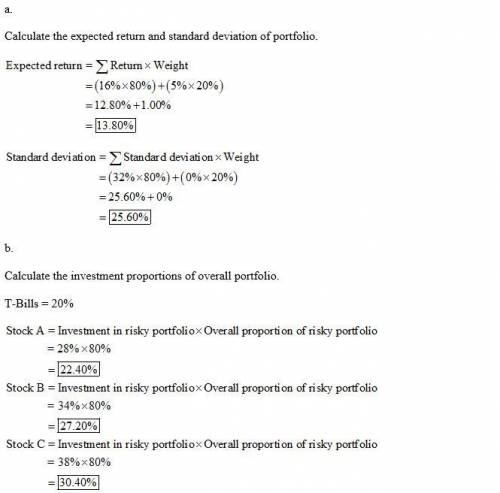

c. What is the reward-to-volatility ratio (S) of your risky portfolio and your client's overall portfolio? (Round your answers to 4 decimal places.)

Reward-to-Volatility Ratio

Risky portfolio

Client’s overall portfolio

Answers: 3

Another question on Business

Business, 22.06.2019 02:30

The amberssen specialty company is a chain of twelve retail stores that sell a variety of imported gift items, gourmet chocolates, cheeses, and wines in the toronto area. amberssen has an is staff of three people who have created a simple but effective information system of networked point-of-sale registers at the stores and a centralized accounting system at the company head- quarters. harry hilman, the head of amberssens is group, has just received the following memo from bill amberssen, sales director (and son of amberssen’s founder). harry—it’s time amberssen specialty launched itself on the internet. many of our competitors are already there, selling to customers without the expense of a retail storefront, and we should be there too. i project that we could double or triple our annual revenues by selling our products on the internet. i’d like to have this ready by - giving, in time for the prime holiday gift-shopping season. bill after pondering this memo for several days, harry scheduled a meeting with bill so that he could clarify bill’s vision of this venture. using the standard con- tent of a system request as your guide, prepare a list of questions that harry needs to have answered about this project.

Answers: 1

Business, 22.06.2019 05:00

Which of the following are considered needs? check all that apply

Answers: 1

Business, 22.06.2019 16:50

Slow ride corp. is evaluating a project with the following cash flows: year cash flow 0 –$12,000 1 5,800 2 6,500 3 6,200 4 5,100 5 –4,300 the company uses a 11 percent discount rate and an 8 percent reinvestment rate on all of its projects. calculate the mirr of the project using all three methods using these interest rates.

Answers: 2

Business, 22.06.2019 20:10

The gilbert instrument corporation is considering replacing the wood steamer it currently uses to shape guitar sides. the steamer has 6 years of remaining life. if kept,the steamer will have depreciaiton expenses of $650 for five years and $325 for the sixthyear. its current book value is $3,575, and it can be sold on an internet auction site for$4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the endof its useful life. gilbert is considering purchasing the side steamer 3000, a higher-end steamer, whichcosts $12,000 and has an estimated useful life of 6 years with an estimated salvage value of$1,500. this steamer falls into the macrs 5-year class, so the applicable depreciationrates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. the new steamer is fasterand allows for an output expansion, so sales would rise by $2,000 per year; the newmachine's much greater efficiency would reduce operating expenses by $1,900 per year.to support the greater sales, the new machine would require that inventories increase by$2,900, but accounts payable would simultaneously increase by $700. gilbert's marginalfederal-plus-state tax rate is 40%, and its wacc is 15%.a. should it replace the old steamer? b. npv of replace = $2,083.51

Answers: 2

You know the right answer?

Assume that you manage a risky portfolio with an expected rate of return of 16% and a standard devia...

Questions

English, 19.09.2019 19:30

History, 19.09.2019 19:30

History, 19.09.2019 19:30

Health, 19.09.2019 19:30

History, 19.09.2019 19:30

Chemistry, 19.09.2019 19:30

Social Studies, 19.09.2019 19:30

Mathematics, 19.09.2019 19:30

Chemistry, 19.09.2019 19:30

English, 19.09.2019 19:30

History, 19.09.2019 19:30