Business, 07.03.2020 05:14 madisonstearly210

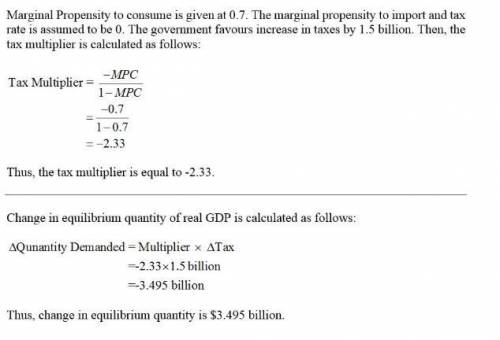

Suppose the marginal propensity to consume is 0.7 and the government votes to increase taxes by $1.5 billion. Round to the nearest tenth if necessary. Assume the tax rate and the marginal propensity to import are 0. Calculate the tax multiplier. tax multiplier:-2.3 Calculate the resulting change in the equilibrium quantity of real GDP demanded. S 3.5 billion

Answers: 3

Another question on Business

Business, 21.06.2019 14:30

John f. kennedy believed that a leader should be elected successful a lifelong student in the military

Answers: 3

Business, 22.06.2019 05:20

What are the general categories of capital budget scenarios? describe the overall decision-making context for each.

Answers: 3

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 3

Business, 22.06.2019 19:30

Adisadvantage of corporations is that shareholders have to pay on profits.

Answers: 1

You know the right answer?

Suppose the marginal propensity to consume is 0.7 and the government votes to increase taxes by $1.5...

Questions

Mathematics, 25.09.2021 08:20

Mathematics, 25.09.2021 08:20

Mathematics, 25.09.2021 08:20

Mathematics, 25.09.2021 08:20

Mathematics, 25.09.2021 08:20

Mathematics, 25.09.2021 08:30

Business, 25.09.2021 08:30

English, 25.09.2021 08:30