Business, 07.03.2020 05:42 laqu33n021

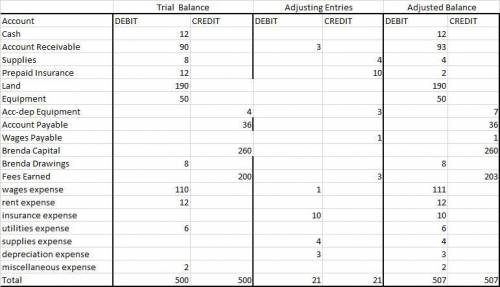

Alert Security Services Co. offers security services to business clients. The trial balance for Alert Security Services Co. has been prepared on the following end-of-period spreadsheet for the year ended October 31, 2016:

Alert Security Services Co.

End-of-Period Spreadsheet

For the Year Ended October 31, 2016

Unadjusted Trial Balance Adjustments Adjusted Trial Balance

Account Title Debit Credit Debit Credit Debit Credit

Cash 12

Accounts Receivable 90

Supplies 8

Prepaid Insurance 12

Land 190

Equipment 50

Accum. Depr.—Equipment 4

Accounts Payable 36

Wages Payable 0

Brenda Schultz, Capital 260

Brenda Schultz, Drawing 8

Fees Earned 200

Wages Expense 110

Rent Expense 12

Insurance Expense 0

Utilities Expense 6

Supplies Expense 0

Depreciation Expense 0

Miscellaneous Expense 2

500 500

The data for year-end adjustments are as follows:

• Fees earned, but not yet billed, $13.

• Supplies on hand, $4.

• Insurance premiums expired, $10.

• Depreciation expense, $3.

• Wages accrued, but not paid, $1.

Enter the adjustment data, and place the balances in the Adjusted Trial Balance columns. Leave cells blank that do not require an entry.

Enter the adjustment data, and place the balances in the Adjusted Trial Balance columns. Leave cells blank that do not require an entry.

Alert Security Services Co.

End-of-Period Spreadsheet

For the Year Ended October 31, 2016

1

Unadjusted

Unadjusted

Adjusted

Adjusted

2

Trial Balance

Trial Balance

Adjustments

Adjustments

Trial Balance

Trial Balance

3

Debit

Credit

Debit

Credit

Debit

Credit

4

Cash

12.00

5

Accounts Receivable

90.00

6

Supplies

8.00

7

Prepaid Insurance

12.00

8

Land

190.00

9

Equipment

50.00

10

Accumulated Depreciation-Equipment

4.00

11

Accounts Payable

36.00

12

Wages Payable

0.00

13

Brenda Schultz, Capital

260.00

14

Brenda Schultz, Drawing

8.00

15

Fees Earned

200.00

16

Wages Expense

110.00

17

Rent Expense

12.00

18

Insurance Expense

0.00

19

Utilities Expense

6.00

20

Supplies Expense

0.00

21

Depreciation Expense

0.00

22

Miscellaneous Expense

2.00

23

Totals

$500.00

$500.00

Answers: 2

Another question on Business

Business, 22.06.2019 17:30

Alinguist had a gross income of 53,350 last year. if 17.9% of his income got witheld for federal income tax, how much of the linguist's pay got witheld for federal income tax last year?

Answers: 2

Business, 23.06.2019 01:00

Why does the downward-sloping production possibilities curve imply that factors of production are scarce?

Answers: 1

Business, 23.06.2019 03:20

With only a part-time job and the need for a professional wardrobe, rachel quickly maxed out her credit card the summer after graduation. with her first full-time paycheck in august, she vowed to pay $270 each month toward paying down her $8 comma 368 outstanding balance and not to use the card. the card has an annual interest rate of 18 percent. how long will it take rachel to pay for her wardrobe? should she shop for a new card? why or why not?

Answers: 2

Business, 23.06.2019 06:00

For each example, identify the most appropriate ctso.marilyn is a middle-school student who wants to prepare for a career in farming: pasnational ffanyfeafeajanice is a high-school student who wants to start her own business: skillsusatsapasdecaabe is a high-school student who wants to become an information technology worker: hosafcclabpanyfearene wants to teach middle-school classes: feafccladecahosa

Answers: 1

You know the right answer?

Alert Security Services Co. offers security services to business clients. The trial balance for Aler...

Questions

English, 16.12.2020 18:10

Mathematics, 16.12.2020 18:10

Health, 16.12.2020 18:10

Mathematics, 16.12.2020 18:10

Mathematics, 16.12.2020 18:10

Mathematics, 16.12.2020 18:10

English, 16.12.2020 18:10

Biology, 16.12.2020 18:10

Mathematics, 16.12.2020 18:10