Business, 07.03.2020 05:30 gabbysanchez5976

Plata Company produces two products: a mostly handcrafted soft leather briefcase sold under the label Maletin Elegant and a leather briefcase produced largely through automation and sold under the label Maletin Fina. The two products use two overhead activities, with the following costs:

Setting up equipment $ 5,000

Machining 20,000

The controller has collected the expected annual prime costs for each briefcase, the machine hours, the setup hours, and the expected production.

Elegant Fina

Direct labor $9,000 $3,000

Direct materials $3,000 $3,000

Units 3,000 3,000

Machine hours 500 4,500

Setup hours 100 100

Required:

1. Conceptual Connection: Do you think that the direct labor costs and direct materials costs are accurately traced to each briefcase? Explain.

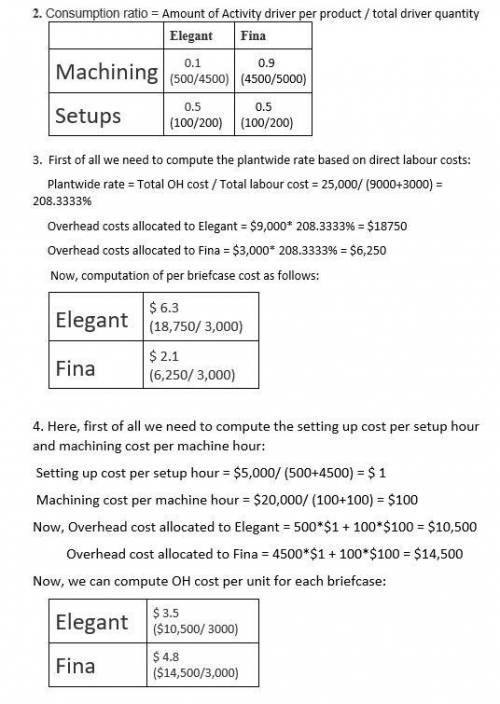

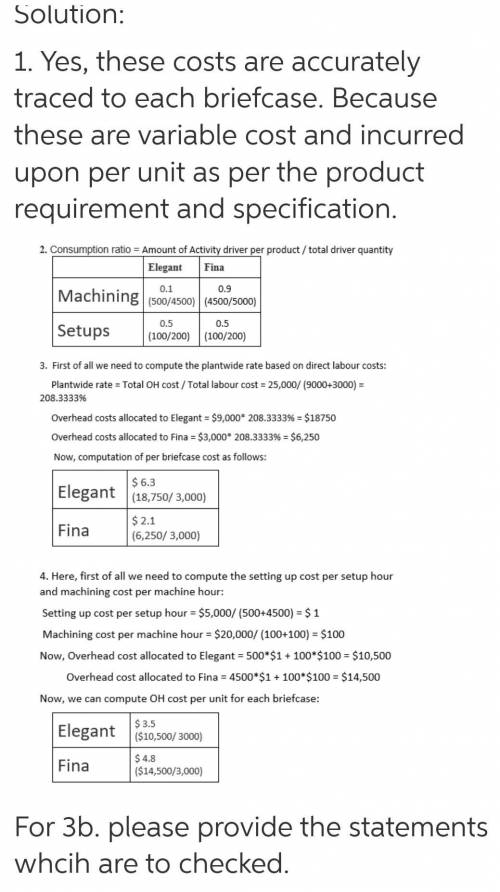

2. Calculate the consumption ratios for each activity. Round your answers to one decimal place.

Elegant Fina

Machining

Setups

3a. Calculate the overhead cost per unit for each briefcase by using a plantwide rate based on direct labor costs. Round to the nearest cent. (Note: Do not round intermediate calculations.)

Elegant $ per briefcase

Fina $ per briefcase

3b. Based on your calculations above which of the following statements is correct?

4. Conceptual Connection: Calculate the overhead cost per unit for each briefcase by using overhead rates based on machine hours and setup hours. Round your answers to the nearest cent.

Elegant $ per unit

Fina $ per unit

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

The production manager of rordan corporation has submitted the following quarterly production forecast for the upcoming fiscal year: 1st quarter 2nd quarter 3rd quarter 4th quarter units to be produced 10,800 8,500 7,100 11,200 each unit requires 0.25 direct labor-hours, and direct laborers are paid $20.00 per hour. required: 1. prepare the company’s direct labor budget for the upcoming fiscal year. assume that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced. 2. prepare the company’s direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. instead, assume that the company’s direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 2,500 hours of work each quarter. if the number of required direct labor-hours is less than this number, the workers are paid for 2,500 hours anyway. any hours worked in excess of 2,500 hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor.

Answers: 2

Business, 22.06.2019 13:10

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

Business, 22.06.2019 19:00

It is estimated that over 100,000 students will apply to the top 30 m.b.a. programs in the united states this year. a. using the concept of net present value and opportunity cost, when is it rational for an individual to pursue an m.b.a. degree. b. what would you expect to happen to the number of applicants if the starting salaries of managers with m.b.a. degrees remained constant but salaries of managers without such degrees decreased by 20 percent

Answers: 3

Business, 22.06.2019 20:00

Suppose a country's productivity last year was 84. if this country's productivity growth rate of 5 percent is to be maintained, this means that this year's productivity will have to be:

Answers: 2

You know the right answer?

Plata Company produces two products: a mostly handcrafted soft leather briefcase sold under the labe...

Questions

Geography, 01.03.2021 16:40

Mathematics, 01.03.2021 16:40

Mathematics, 01.03.2021 16:40

Mathematics, 01.03.2021 16:40

Advanced Placement (AP), 01.03.2021 16:40

Mathematics, 01.03.2021 16:40

Chemistry, 01.03.2021 16:40