Business, 07.03.2020 05:59 loveagirl111puppy

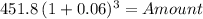

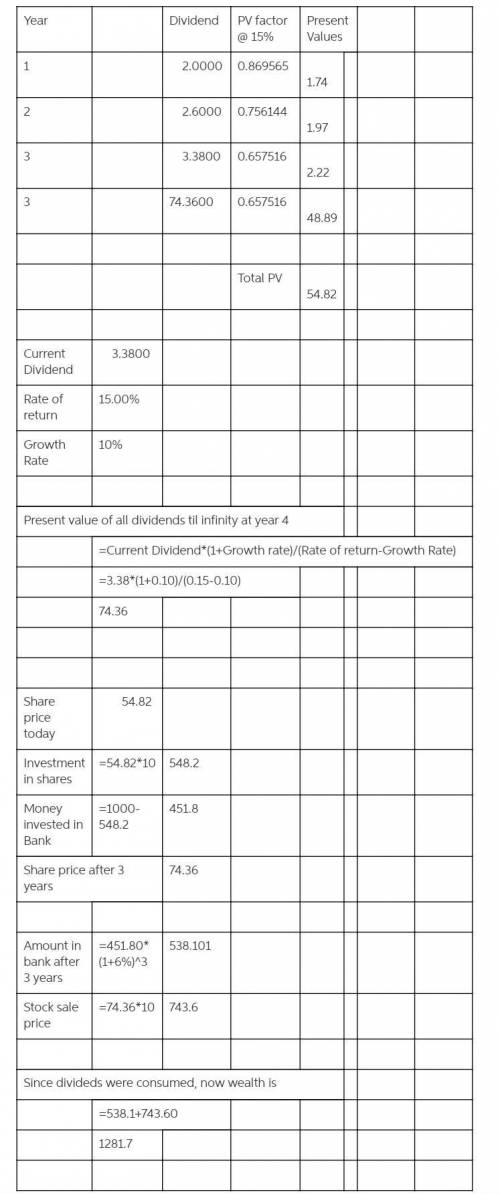

The Goliath Inc. decides to pay the following dividends over the next three years: $2, $2.6, and $3.38. Thereafter, the company will maintain a constant 10% growth rate in dividends forever. The required return of Goliath’s stock is 15%. Suppose Victor has $1000 today. He decides to buy 10 shares of Goliath’s stock today and save the rest of his $1000 into the Whales Cargo bank, which provides an annual interest rate of 6%. Victor will sell his shares of Goliath’s stock in year 3 and withdraw the money from the bank as well. Victor wants to know how much money he can have in year 3, with such an investment plan.

What is the stock price of Goliath Inc. today?

How much money can Victor save in the bank today?

What is the stock price (per share) of Goliath Inc. when Victor sells it in year 3 (immediately after the third dividend is paid out)?

How much money can Victor withdraw from the bank in year 3?

With such an investment plan, how much money will Victor have in year 3? Suppose Victor consumes all his dividends over these years and his wealth consists of the capital gains from the stock and the money withdrawal from the bank.

Answers: 2

Another question on Business

Business, 22.06.2019 17:40

Croy inc. has the following projected sales for the next five months: month sales in units april 3,850 may 3,875 june 4,260 july 4,135 august 3,590 croy’s finished goods inventory policy is to have 60 percent of the next month’s sales on hand at the end of each month. direct material costs $2.50 per pound, and each unit requires 2 pounds. raw materials inventory policy is to have 50 percent of the next month’s production needs on hand at the end of each month. raw materials on hand at march 31 totaled 3,741 pounds. 1. determine budgeted production for april, may, and june. 2. determine the budgeted cost of materials purchased for april, may, and june. (round your answers to 2 decimal places.)

Answers: 3

Business, 22.06.2019 19:40

The martinez legal firm (mlf) recently acquired a smaller competitor, miller and associates, which specializes in issues not previously covered by mlf, such as land use and intellectual property cases. given the increase in the firm's size and complexity, it is likely that its internal transaction costs willa. decrease. b. increase. c. become external transaction costs. d. be eliminated.

Answers: 3

Business, 22.06.2019 20:00

How many organs are supplied at a zero price? (b) how many people die in the government-regulated economy where the government-set price ceiling is p = 0? the quantity qd – qa. the quantity qe – qa. the quantity qd – qe. (c) how many people die in the market-driven economy?

Answers: 1

Business, 22.06.2019 20:40

Helen tells her nephew, bernard, that she will pay him $100 if he will stop smoking for six months. helen was hopeful that if bernard stopped smoking for six months, he would stop altogether. bernard stops smoking for six months but then resumes his smoking. helen will not pay him. she says that the type of promise she made cannot constitute a binding contract and that, furthermore, it was at least implied that he would stop smoking for good. can bernard legally collect $100 from helen

Answers: 1

You know the right answer?

The Goliath Inc. decides to pay the following dividends over the next three years: $2, $2.6, and $3....

Questions

Social Studies, 11.02.2020 06:01

Mathematics, 11.02.2020 06:01

Chemistry, 11.02.2020 06:01

Mathematics, 11.02.2020 06:01

Mathematics, 11.02.2020 06:01

Mathematics, 11.02.2020 06:01

Biology, 11.02.2020 06:01

Mathematics, 11.02.2020 06:01

Mathematics, 11.02.2020 06:01

![\left[\begin{array}{ccc}Years&Cashflow&Discounted\\&&\\1&2&1.74\\2&2.6&1.97\\3&3.38&2.22\\3&74.36&48.89\\&total&54.82\\\end{array}\right]](/tpl/images/0538/0564/b686a.png)