Business, 10.03.2020 01:33 angelrgomez01

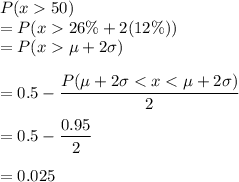

A hedge fund returns on average 26% per year with a standard deviation of 12%. Using the empirical rule, approximate the probability the fund returns over 50% next year

Answers: 2

Another question on Business

Business, 22.06.2019 10:10

At the end of year 2, retained earnings for the baker company was $3,550. revenue earned by the company in year 2 was $3,800, expenses paid during the period were $2,000, and dividends paid during the period were $1,400. based on this information alone, retained earnings at the beginning of year 2 was:

Answers: 1

Business, 22.06.2019 17:20

“strategy, plans, and budgets are unrelated to one another.” do you agree? explain. explain how the manager’s choice of the type of responsibility center (cost, revenue, profit, or investment) affects the behavior of other employees.

Answers: 3

Business, 23.06.2019 03:00

Depasquale corporation is working on its direct labor budget for the next two months. each unit of output requires 0.61 direct labor-hours. the direct labor rate is $8.70 per direct labor-hour. the production budget calls for producing 6,700 units in may and 7,100 units in june. if the direct labor work force is fully adjusted to the total direct labor-hours needed each month, what would be the total combined direct labor cost for the two months?

Answers: 3

You know the right answer?

A hedge fund returns on average 26% per year with a standard deviation of 12%. Using the empirical r...

Questions

Mathematics, 16.12.2020 04:20

Mathematics, 16.12.2020 04:20

History, 16.12.2020 04:20

Mathematics, 16.12.2020 04:20

History, 16.12.2020 04:20

Mathematics, 16.12.2020 04:20

Chemistry, 16.12.2020 04:20

Mathematics, 16.12.2020 04:20

Mathematics, 16.12.2020 04:20

Mathematics, 16.12.2020 04:20

Physics, 16.12.2020 04:20

Mathematics, 16.12.2020 04:20

Physics, 16.12.2020 04:30