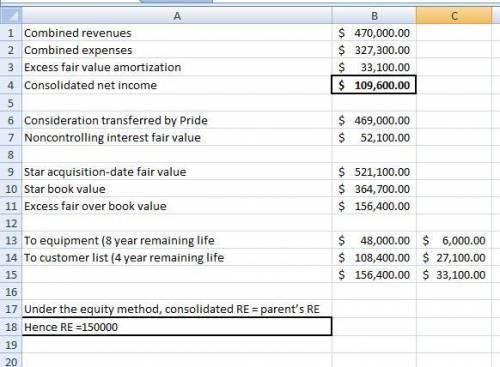

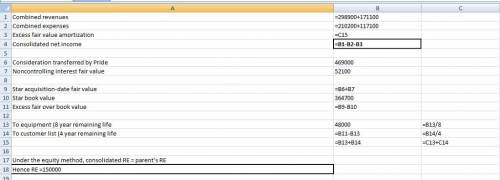

On January 1, 2016, Pride Corporation purchased 90 percent of the outstanding voting shares of Star, Inc. for $469,000 cash. The acquisition-date fair value of the noncontrolling interest was $52,100. At January 1, 2016, Star’s net assets had a total carrying amount of $364,700. Equipment (eight-year remaining life) was undervalued on Star’s financial records by $48,000. Any remaining excess fair value over book value was attributed to a customer list developed by Star (four-year remaining life), but not recorded on its books. Star recorded net income of $42,000 in 2016 and $48,000 in 2017. Each year since the acquisition, Star has declared a $12,000 dividend. At January 1, 2018, Pride’s retained earnings show a $150,000 balance.

Selected account balances for the two companies from their separate operations were as follows:

Pride Star

2018 Revenues $ 298,900 $ 171,100

2018 Expenses 210,200 117,100

Assuming that Pride, in its internal records, accounts for its investment in Star using the equity method, what amount of retained earnings would Pride report on its January 1, 2018 consolidated balance sheet?

What is consolidated net income for 2018?

Answers: 1

Another question on Business

Business, 22.06.2019 01:30

Consider the following limit order book for a share of stock. the last trade in the stock occurred at a price of $50. limit buy orders limit sell orders price shares price shares $49.75 500 $49.80 100 49.70 900 49.85 100 49.65 700 49.90 300 49.60 400 49.95 100 48.65 600 a. if a market buy order for 100 shares comes in, at what price will it be filled? (round your answer to 2 decimal places.) b. at what price would the next market buy order be filled? (round your answer to 2 decimal places.) c. if you were a security dealer, would you want to increase or decrease your inventory of this stock? increase decrease

Answers: 2

Business, 22.06.2019 10:00

Scenario: you have advised the owner of bond's gym that the best thing to do would be to raise the price of a monthly membership. the owner wants to know what may happen once this price increase goes into effect. what will most likely occur after the price of a monthly membership increases? check all that apply. current members will pay more per month. the quantity demanded for memberships will decrease. the number of available memberships will increase. the owner will make more money. bond's gym will receive more membership applications.

Answers: 1

Business, 22.06.2019 18:50

Plastic and steel are substitutes in the production of body panels for certain automobiles. if the price of plastic increases, with other things remaining the same, we would expect: a) the demand curve for plastic to shift to the left. b) the price of steel to fall. c) the demand curve for steel to shift to the left d) nothing to happen to steel because it is only a substitute for plastic. e) the demand curve for steel to shift to the right

Answers: 3

Business, 23.06.2019 03:00

You are considering purchasing a company — assets, liabilities, warts, and all. you are aware that sometimes liabilities do not always show up on the balance sheet. discuss five examples of liabilities that may not be explicitly recognized on the balance sheet, making sure to explain why they are liabilities.

Answers: 1

You know the right answer?

On January 1, 2016, Pride Corporation purchased 90 percent of the outstanding voting shares of Star,...

Questions