Business, 10.03.2020 03:59 dlaskey646

During 2020, Nilsen Company started a construction job with a contract price of $1,600,000. The job was completed in 2022. The following information is available.

2014 2015 2016

Costs incurred to date $400,000 $825,000 $1070,000

Estimated costs to complete 600,000 275,000 0

Billings to date 300,000 900,000 1600,000

Collections to date 270,000 810,000 14,25000

Required:

a. Compute the amount of gross profit to be recognized each year, assuming the percentage-of-completion method is used.

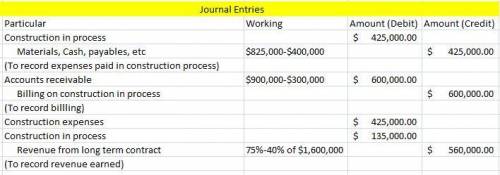

b. Prepare all necessary journal entries for 2015

c. Compute the amount of gross profit to be recognized each year, assuming the completed-contract method is used.

Answers: 3

Another question on Business

Business, 22.06.2019 05:00

Ajewelry direct sales company pays its consultants based on recruiting new members. question 1 options: the company is running a pyramid scheme, which is illegal. the company is running a pyramid scheme, which is legal. the company has implemented a legal and ethical plan for growth. the company uses this method of compensation to reduce the fee for the product sample kit.

Answers: 3

Business, 22.06.2019 08:30

Match each item to check for while reconciling a bank account with the document to which it relates.(there's not just one answer)1. balancing account statement2. balancing check registera. nsf feesb. deposits in transitc. interest earnedd. bank errors

Answers: 2

Business, 22.06.2019 15:00

Oerstman, inc. uses a standard costing system and develops its overhead rates from the current annual budget.the budget is based on an expected annual output of 120,000 units requiring 480,000 direct labor hours.(practical capacity is 500,000 hours)annual budgeted overhead costs total $772,800, of which $556,800 is fixed overhead.a total of 119,300 units, using 478,000 direct labor hours, were produced during the year.actual variable overhead costs for the year were $260,400 and actual fixed overhead costs were $555,450.required: 1. compute the fixed overhead spending variance and indicate if favorable or unfavorable.2. compute the fixed overhead volume variance and indicate if favorable or unfavorable.

Answers: 3

You know the right answer?

During 2020, Nilsen Company started a construction job with a contract price of $1,600,000. The job...

Questions

SAT, 27.01.2020 18:31

English, 27.01.2020 18:31

History, 27.01.2020 18:31

History, 27.01.2020 18:31

Spanish, 27.01.2020 18:31

Health, 27.01.2020 18:31

Mathematics, 27.01.2020 18:31

Mathematics, 27.01.2020 18:31

Mathematics, 27.01.2020 18:31

Chemistry, 27.01.2020 18:31

Mathematics, 27.01.2020 18:31

Mathematics, 27.01.2020 18:31

History, 27.01.2020 18:31

Chemistry, 27.01.2020 18:31

Mathematics, 27.01.2020 18:31