Business, 10.03.2020 07:57 fraven1819

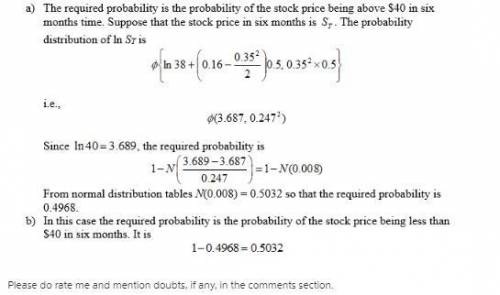

A stock price follows geometric Brownian motion with an expected return of 16% and a volatility of 35%. The current price is $38. a) What is the probability that a European call option on the stock with an exercise price of $40 and a maturity date in six months will be exercised(b) What is the probability that a European put option on the stock with the same exercise price and maturity will be exercised?

Answers: 1

Another question on Business

Business, 22.06.2019 09:00

Afood worker has just rinsed a dish after cleaning it.what should he do next?

Answers: 2

Business, 22.06.2019 12:50

Afirm’s production function is represented by q(m,r) = 4m 3/4r1/3, where q denotes output, m raw materials, and r robots. the firm is currently using 6 units of raw materials and 12 robots. according to the mrts, in order to maintain its output level the firm would need to give up 2 robots if it adds 9 units of raw materials. (a) true (b) false

Answers: 3

Business, 22.06.2019 15:30

Brenda wants a new car that will be dependable transportation and look good. she wants to satisfy both functional and psychological needs. true or false

Answers: 1

You know the right answer?

A stock price follows geometric Brownian motion with an expected return of 16% and a volatility of 3...

Questions

Mathematics, 05.05.2020 00:38

Mathematics, 05.05.2020 00:38

English, 05.05.2020 00:38

Mathematics, 05.05.2020 00:38

Social Studies, 05.05.2020 00:38

English, 05.05.2020 00:38

Mathematics, 05.05.2020 00:38

English, 05.05.2020 00:38

History, 05.05.2020 00:38