Business, 10.03.2020 09:23 ultimatesaiyan

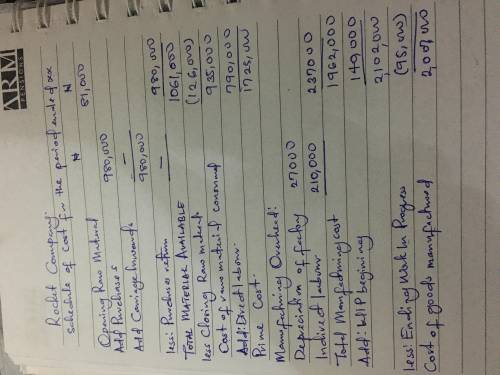

Rocket Company produces small gasoline-powered engines for model airplanes. Mr. Clemens, Rocket�s CFO, has presented you with the following cost information: Direct Materials Inventory, beginning $ 81,000 Direct Materials Inventory, ending $ 126,000 Work in Process Inventory, beginning $ 140,000 Work in Process Inventory, ending $ 95,000 Direct labor $ 790,000 Direct materials purchases $ 980,000 Insurance, factory $ 52,000 Depreciation, factory $ 27,000 Depreciation, executive offices $ 12,000 Indirect labor $ 210,000 Utilities, factory $ 17,000 Utilities, executive offices $ 9,000 Property taxes, factory $ 16,000 Property taxes, executive offices $ 12,000 Using this cost information, prepare a cost of goods manufactured schedule for Mr. Clemens.

Answers: 2

Another question on Business

Business, 22.06.2019 19:20

This problem has been solved! see the answerwhich of the following statements is correct? the consumer price index is a measure of the overall level of prices, whereas the gdp deflator is not a measure of the overall level of prices. if, in the year 2011, the consumer price index has a value of 123.50, then the inflation rate for 2011 must be 23.50 percent. compared to the gdp deflator, the consumer price index is the more common gauge of inflation. the consumer price index and the gdp deflator reflect the goods and services bought by consumers equally well.

Answers: 2

Business, 23.06.2019 02:00

Suppose that a major city’s main thoroughfare, which is also an interstate highway, will be completely closed to traffic for two years, from january 2014 to december 2015, for reconstruction at a cost of $535 million. if the construction company were to keep the highway open for traffic during construction, the highway reconstruction project would take much longer and be more expensive. suppose that construction would take four years if the highway were kept open, at a total cost of $800 million. the state department of transportation had to make its decision in 2014, one year before the start of construction (so that the first payment was one year away). so the department of transportation had the following choices: (i) close the highway during construction, at an annual cost of $267.5 million per year for two years. (ii) keep the highway open during construction, at an annual cost of $200 million per year for four years. now suppose the interest rate is 80%. calculate the present value of the costs incurred under each plan.

Answers: 3

Business, 23.06.2019 03:00

If joe to go decides to produce its coffee beans domestically and sell them in india through a local retailer, this would be an example of

Answers: 2

Business, 23.06.2019 22:00

According to federal regulations, an irb must have at least two community members to fulfill membership requirements; one member whose expertise is not in a scientific area and one member who is not affiliated with the institution.

Answers: 1

You know the right answer?

Rocket Company produces small gasoline-powered engines for model airplanes. Mr. Clemens, Rocket�s CF...

Questions

Mathematics, 30.05.2021 07:10

Mathematics, 30.05.2021 07:10

Health, 30.05.2021 07:10

Computers and Technology, 30.05.2021 07:10

Mathematics, 30.05.2021 07:10

Mathematics, 30.05.2021 07:10

English, 30.05.2021 07:10

English, 30.05.2021 07:10

Mathematics, 30.05.2021 07:20

Physics, 30.05.2021 07:20

English, 30.05.2021 07:20

Mathematics, 30.05.2021 07:20