Business, 10.03.2020 09:14 skylarsikora22

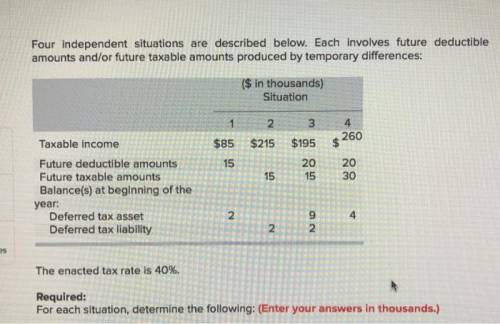

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

($ in thousands)

Situation

1 2 3 4

Taxable income $85 $215 $195 $260

Future deductible amounts 15 20 20

Future taxable amounts 15 15 30

Balance(s) at beginning of the year:

Deferred tax asset 2 9 4

Deferred tax liability 2 2

The enacted tax rate is 40%.

Required:

For each situation, determine the following:

a. Income tax payable currently.

b. Deferred tax asset—balance.

c. Deferred tax asset—change (dr) cr.

d. Deferred tax liability—balance.

e. Deferred tax liability—change (dr) cr.

f. Income tax expense.

Answers: 2

Another question on Business

Business, 21.06.2019 18:20

Amathematical approximation called the rule of 70 tells us that the number of years that it will take something that is growing to double in size is approximately equal to the number 70 divided by its percentage rate of growth. thus, if mexico's real gdp per person is growing at 7 percent per year, it will take about 10 years(=70/7) to double. apply the rule of 70 to solve the following problem. real gdp per person in mexico in 2005 was about $11,000 per person, while it was about $44,000 per person in the u.s. if real gdp per person in mexico grows at the rate of 5 percent per year: how long will it take mexico's real gdp per person to reach the level that the united states was at in 2005? (hint: how many times would mexico's 2005 real gdp per person have to double to reach the u.s.'s 2005 real gdp per person?

Answers: 3

Business, 21.06.2019 20:30

As a group is leaving, you ask them if they had a good experience at the restaurant. they mention that they had poor service and their food was cold. a.apologize and ask them to give the restaurant another chance in the future. you tell them that guests usually have a great experience here. b.apologize then ask for the server’s name and immediately notify the manager after they leave. c.apologize for the bad experience and ask them to wait as you call the manager to talk to them. d.apologize for the bad experience and encourage them to complete the customer service survey. this feedback will ensure other guests do not have the same experience.

Answers: 2

Business, 22.06.2019 08:30

Kiona co. set up a petty cash fund for payments of small amounts. the following transactions involving the petty cash fund occurred in may (the last month of the company's fiscal year). may 1 prepared a company check for $350 to establish the petty cash fund. 15 prepared a company check to replenish the fund for the following expenditures made since may 1. a. paid $109.20 for janitorial services. b. paid $89.15 for miscellaneous expenses. c. paid postage expenses of $60.90. d. paid $80.01 to the county gazette (the local newspaper) for an advertisement. e. counted $26.84 remaining in the petty cashbox. 16 prepared a company check for $200 to increase the fund to $550. 31 the petty cashier reports that $380.27 cash remains in the fund. a company check is drawn to replenish the fund for the following expenditures made since may 15. f. paid postage expenses of $59.10. g. reimbursed the office manager for business mileage, $47.05. h. paid $48.58 to deliver merchandise to a customer, terms fob destination. 31 the company decides that the may 16 increase in the fund was too large. it reduces the fund by $50, leaving a total of $500.

Answers: 1

Business, 22.06.2019 19:50

Juan's investment portfolio was valued at $125,640 at the beginning of the year. during the year, juan received $603 in interest income and $298 in dividend income. juan also sold shares of stock and realized $1,459 in capital gains. juan's portfolio is valued at $142,608 at the end of the year. all income and realized gains were reinvested. no funds were contributed or withdrawn during the year. what is the amount of income juan must declare this year for income tax purposes?

Answers: 1

You know the right answer?

Four independent situations are described below. Each involves future deductible amounts and/or futu...

Questions

English, 31.10.2021 07:30

Mathematics, 31.10.2021 07:30

Mathematics, 31.10.2021 07:30

Chemistry, 31.10.2021 07:30

Mathematics, 31.10.2021 07:40

Mathematics, 31.10.2021 07:40

Mathematics, 31.10.2021 07:40

Mathematics, 31.10.2021 07:40

Mathematics, 31.10.2021 07:40

Mathematics, 31.10.2021 07:40

English, 31.10.2021 07:40