Business, 10.03.2020 21:23 serenityharmon1

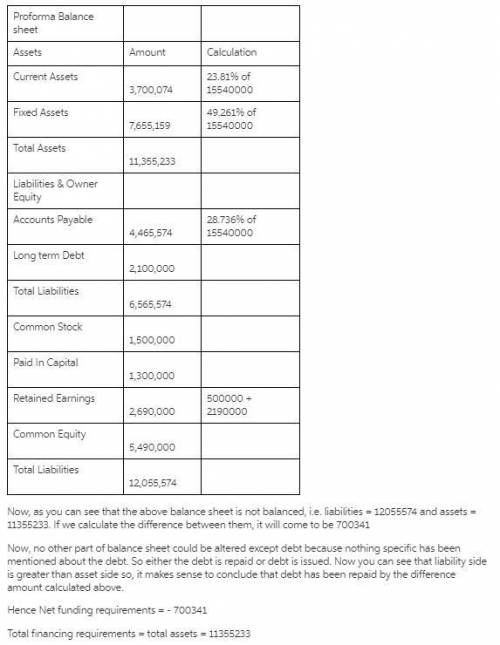

Zapatera Enterprises is evaluating its financing requirements for the coming year. The firm has only been in business for one year, but its CFO predicts that the firm's operating expenses, current assets, net fixed assets, and current liabilities will remain at their current proportion of sales. Last year Zapatera had $12.42 million in sales with a net income of $1.22 million. The firm anticipates that next year's sales will reach $15.92 million with net income rising to $2.15 million. Given its present high rate of growth, the firm retains all of its earnings to help defray the cost of new investments. The firm's balance sheet for the year just ended is as follows: Current assets $3 millionNet fixed assets $5.6 millionAccounts payable $3.2 millionLong-term debt $1.9 millionCommon stock $1.3 millionPaid-in capital $1.7 millionRetained earnings $500,000Common equity $3.5 millionEstimate Zapatera's financing requirements(that is, total assets) for 2014 and its discretionary financing needs(DFN).

Answers: 3

Another question on Business

Business, 22.06.2019 16:40

Determining effects of stock splits oracle corp has had the following stock splits since its inception. effective date split amount october 12, 2000 2 for 1 january 18, 2000 2 for 1 february 26, 1999 3 for 2 august 15, 1997 3 for 2 april 16, 1996 3 for 2 february 22, 1995 3 for 2 november 8, 1993 2 for 1 june 16,1989 2 for 1 december 21, 1987 2 for 1 march 9, 1987 2 for 1 a. if the par value of oracle shares was originally $2, what would oracle corp. report as par value per share on its 2015 balance sheet? compute the revised par value after each stock split. round answers to three decimal places.

Answers: 1

Business, 23.06.2019 20:10

Adog whistle manufacturer's factory was located near a residential area. the manufacturer used the most effective methods for testing its whistles, but it was impossible to completely soundproof the testing area. a breeder of champion show dogs bought some property near the factory and raised and trained her dogs there. although the whistles were too high-pitched to be perceived by human ears, they could be heard by the breeder's dogs. consequently, the dogs often were in a constant state of agitation. in a suit by the breeder against the manufacturer, what is the likely outcome? response - correct a the breeder will prevail on a trespass theory, because the sound waves are entering onto the breeder's property. b the breeder will prevail on a nuisance theory, because the sound of the whistles is a substantial interference with the breeder's use of her land. c the breeder will not prevail, because the sound of the whistles is not a substantial interference with the breeder's use of her land. d the breeder will not prevail, because the manufacturer has acted reasonably in testing its whistles.

Answers: 3

You know the right answer?

Zapatera Enterprises is evaluating its financing requirements for the coming year. The firm has only...

Questions

Mathematics, 28.02.2021 03:40

Mathematics, 28.02.2021 03:40

Mathematics, 28.02.2021 03:40

Engineering, 28.02.2021 03:40

Mathematics, 28.02.2021 03:40

Mathematics, 28.02.2021 03:40

Computers and Technology, 28.02.2021 03:40