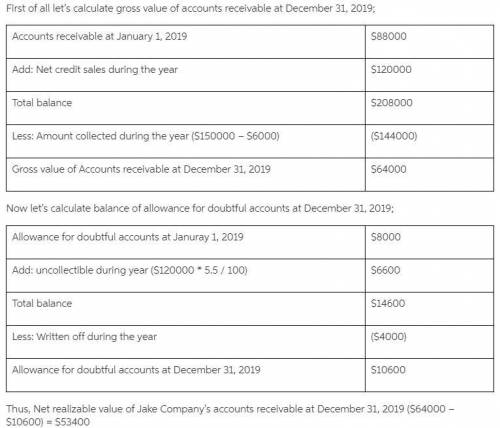

Jake Company records bad debt expense using the net credit sales method and has estimated that 5.5% of its credit sales will prove to be uncollectible. During 2019, Jake Company reported net credit sales of $120,000 and collected $150,000 cash from its credit customers. The $150,000 includes a $6,000 recovery of an account receivable written off in the previous year. During 2019, Jake Company wrote-off as uncollectible accounts receivable of $4,000. Jake Company reported accounts receivable at January 1, 2019, of $88,000 and the allowance for doubtful accounts had an $8,000 credit balance at January 1, 2019.

Calculate the net realizable value of Jake Company's accounts receivable at December 31, 2019.

Please include your calculations and explanation.

Answers: 1

Another question on Business

Business, 22.06.2019 00:00

Chance company had two operating divisions, one manufacturing farm equipment and the other office supplies. both divisions are considered separate components as defined by generally accepted accounting principles. the farm equipment component had been unprofitable, and on september 1, 2018, the company adopted a plan to sell the assets of the division. the actual sale was completed on december 15, 2018, at a price of $600,000. the book value of the division’s assets was $1,000,000, resulting in a before-tax loss of $400,000 on the sale. the division incurred a before-tax operating loss from operations of $130,000 from the beginning of the year through december 15. the income tax rate is 40%. chance’s after-tax income from its continuing operations is $350,000. required: prepare an income statement for 2018 beginning with income from continuing operations. include appropriate eps disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (amounts to be deducted should be indicated with a minus sign. round eps answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 00:10

Which of the following is a problem for the production of public goods?

Answers: 2

Business, 22.06.2019 01:30

Consider the following limit order book for a share of stock. the last trade in the stock occurred at a price of $50. limit buy orders limit sell orders price shares price shares $49.75 500 $49.80 100 49.70 900 49.85 100 49.65 700 49.90 300 49.60 400 49.95 100 48.65 600 a. if a market buy order for 100 shares comes in, at what price will it be filled? (round your answer to 2 decimal places.) b. at what price would the next market buy order be filled? (round your answer to 2 decimal places.) c. if you were a security dealer, would you want to increase or decrease your inventory of this stock? increase decrease

Answers: 2

Business, 22.06.2019 18:00

If you would like to ask a question you will have to spend some points

Answers: 1

You know the right answer?

Jake Company records bad debt expense using the net credit sales method and has estimated that 5.5%...

Questions

Mathematics, 27.05.2021 15:10

History, 27.05.2021 15:10

English, 27.05.2021 15:10

Chemistry, 27.05.2021 15:20

English, 27.05.2021 15:20

Mathematics, 27.05.2021 15:20

History, 27.05.2021 15:20

Social Studies, 27.05.2021 15:20

Mathematics, 27.05.2021 15:20