Business, 11.03.2020 02:09 bellalemieux

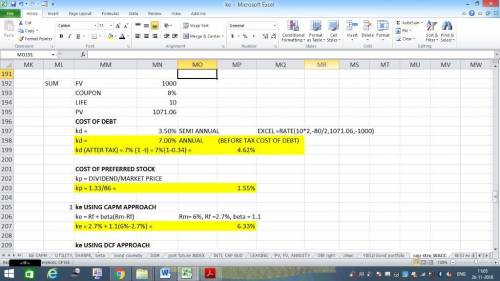

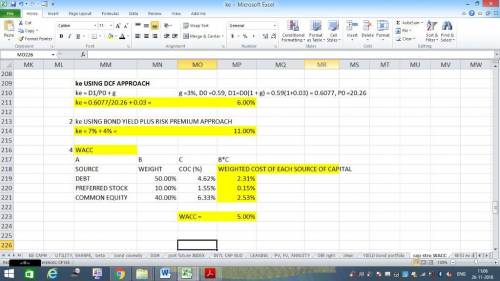

Greenberg Corp. is considering opening a subsidiary to expand its operations. To evaluate the proposal, the company needs to calculate its cost of capital. You've collected the following information:The firm has one bond outstanding with a coupon rate of 8%, paid semi-annually, 10 years to maturity and a current price of $1,071.06, implying a yield to maturity of 7%.The firm's preferred stock pays an annual dividend of $1.33 forever, and each share is currently worth $86.New bonds and preferred stock would be issued by private placement, largely eliminating flotation costs. Greenberg's beta is 1.1, the yield on Treasury bonds is is 2.7% and the expected market risk premium is 6%.The current stock price is $20.26. The firm has just paid an annual dividend of $0.59, which is expected to grow by 3% per year. The firm uses a risk premium of 4% for the bond-yield-plus-risk-premium approach. New equity would come from retained earnings, thus eliminating flotation costs. The firm has marginal tax rate of 34%.The company wants to maintain is current capital structure, which is 40% equity, 10% preferred stock and 50% debt.1. What is the cost of equity using the CAPM?2. What is the cost of equity using the bond yield plus risk premium?3. What is the company's weighted average cost of capital, using the CAPM to find the cost of equity?

Answers: 3

Another question on Business

Business, 21.06.2019 18:20

Alyeska services company, a division of a major oil company, provides various services to the operators of the north slope oil field in alaska. data concerning the most recent year appear below: sales $18,000,000 net operating income $6,300,000 average operating assets $35,200,000 1. compute the margin for alyeska services company. (round your answer to 2 decimal places.) 2. compute the turnover for alyeska services company. (round your answer to 2 decimal places.) 3. compute the return on investment (roi) for alyeska services company. (round your intermediate calculations and final answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 07:40

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 3

Business, 22.06.2019 11:10

Your team has identified the risks on the project and determined their risk score. the team is in the midst of determining what strategies to put in place should the risks occur. after some discussion, the team members have determined that the risk of losing their network administrator is a risk they'll just deal with if and when it occurs. although they think it's a possibility and the impact would be significant, they've decided to simply deal with it after the fact. which of the following is true regarding this question? a. this is a positive response strategy.b. this is a negative response strategy.c. this is a response strategy for either positive or negative risk known as contingency planning.d. this is a response strategy for either positive or negative risks known as passive acceptance.

Answers: 2

You know the right answer?

Greenberg Corp. is considering opening a subsidiary to expand its operations. To evaluate the propos...

Questions

Social Studies, 11.01.2021 01:00

Chemistry, 11.01.2021 01:00

Chemistry, 11.01.2021 01:00

Biology, 11.01.2021 01:00

Chemistry, 11.01.2021 01:00

English, 11.01.2021 01:00

Mathematics, 11.01.2021 01:00

Health, 11.01.2021 01:00

English, 11.01.2021 01:00

Social Studies, 11.01.2021 01:00

Mathematics, 11.01.2021 01:00