Business, 11.03.2020 03:02 ariannapenny98

Whitney received $75,000 of taxable income in 2017. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

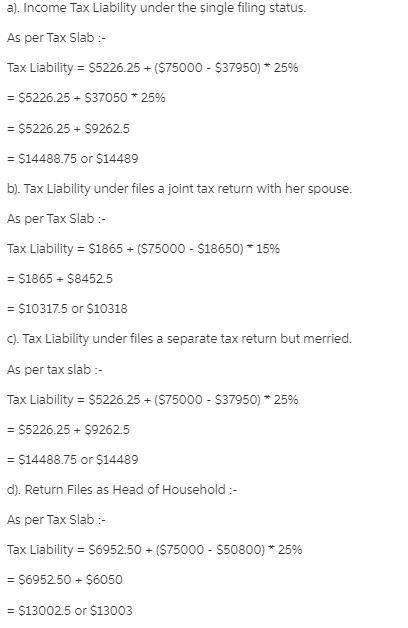

a. She files under the single filing status.

b. She files a joint tax return with her spouse. Together their taxable income is $75,000.

c. She is married but files a separate tax return. Her taxable income is $75,000.

d. She files as a head of household.

Answers: 3

Another question on Business

Business, 22.06.2019 02:30

Consider the local telephone company, a natural monopoly. the following graph shows the monthly demand curve for phone services and the company’s marginal revenue (mr), marginal cost (mc), and average total cost (atc) curves. 0 2 4 6 8 10 12 14 16 18 20 100 90 80 70 60 50 40 30 20 10 0 price (dollars per subscription) quantity (thousands of subscriptions) d mr mc atc 8, 60 suppose that the government has decided not to regulate this industry, and the firm is free to maximize profits, without constraints. complete the first row of the following table. pricing mechanism short run long-run decision quantity price profit (subscriptions) (dollars per subscription) profit maximization marginal-cost pricing average-cost pricing suppose that the government forces the monopolist to set the price equal to marginal cost. complete the second row of the previous table. suppose that the government forces the monopolist to set the price equal to average total cost. complete the third row of the previous table. under average-cost pricing, the government will raise the price of output whenever a firm’s costs increase, and lower the price whenever a firm’s costs decrease. over time, under the average-cost pricing policy, what will the local telephone company most likely do

Answers: 2

Business, 22.06.2019 13:40

After much consideration, you have chosen cancun over ft. lauderdale as your spring break destination this year. however, spring break is still months away, and you may reverse this decision. which of the following events would prompt you to reverse this decision? a. the marginal cost of going to cancun decreases.b. the marginal cost of going to ft. lauderdale decreases.c. the marginal benefit of going to cancun increases.d. the marginal benefit of going to ft. lauderdale decreases.

Answers: 2

Business, 22.06.2019 16:50

Slow ride corp. is evaluating a project with the following cash flows: year cash flow 0 –$12,000 1 5,800 2 6,500 3 6,200 4 5,100 5 –4,300 the company uses a 11 percent discount rate and an 8 percent reinvestment rate on all of its projects. calculate the mirr of the project using all three methods using these interest rates.

Answers: 2

Business, 22.06.2019 18:30

Health insurance protects you if you experience any of the following except: a: if you have to be hospitalized b: if you damage someone's property c: if you need to visit a clinic d: if you can't work because of illness

Answers: 2

You know the right answer?

Whitney received $75,000 of taxable income in 2017. All of the income was salary from her employer....

Questions

History, 22.10.2020 19:01

Computers and Technology, 22.10.2020 19:01

History, 22.10.2020 19:01

Mathematics, 22.10.2020 19:01

Mathematics, 22.10.2020 19:01

Mathematics, 22.10.2020 19:01

Mathematics, 22.10.2020 19:01

Chemistry, 22.10.2020 19:01

Mathematics, 22.10.2020 19:01