Business, 11.03.2020 23:10 Desinfektionsmittel

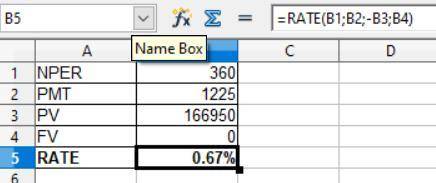

Given the following information about a fully amortizing loan, calculate the lender's yield (rounded to the nearest tenth of a percent). Loan amount: $166,950, Term: 30 years, Interest rate: 8 %, Monthly Payment: $1,225.00, Discount points: 2.

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

You have just been hired as a financial analyst for barrington industries. unfortunately, company headquarters (where all of the firm's records are kept) has been destroyed by fire. so, your first job will be to recreate the firm's cash flow statement for the year just ended. the firm had $100,000 in the bank at the end of the prior year, and its working capital accounts except cash remained constant during the year. it earned $5 million in net income during the year but paid $800,000 in dividends to common shareholders. throughout the year, the firm purchased $5.5 million of machinery that was needed for a new project. you have just spoken to the firm's accountants and learned that annual depreciation expense for the year is $450,000; however, the purchase price for the machinery represents additions to property, plant, and equipment before depreciation. finally, you have determined that the only financing done by the firm was to issue long-term debt of $1 million at a 6% interest rate. what was the firm's end- of-year cash balance? recreate the firm's cash flow statement to arrive at your answer

Answers: 1

Business, 21.06.2019 21:50

You have $22,000 to invest in a stock portfolio. your choices are stock x with an expected return of 11 percent and stock y with an expected return of 13 percent. if your goal is to create a portfolio with an expected return of 11.74 percent, how much money will you invest in stock x? in stock y?

Answers: 2

Business, 22.06.2019 04:40

Dahlia enterprises needs someone to supply it with 127,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you’ve decided to bid on the contract. it will cost you $940,000 to install the equipment necessary to start production; you’ll depreciate this cost straight-line to zero over the project’s life. you estimate that in five years, this equipment can be salvaged for $77,000. your fixed production costs will be $332,000 per year, and your variable production costs should be $11.00 per carton. you also need an initial investment in net working capital of $82,000. if your tax rate is 30 percent and your required return is 11 percent on your investment, what bid price should you submit? (do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16))

Answers: 3

Business, 22.06.2019 11:00

The following transactions occurred during july: received $1,000 cash for services provided to a customer during july. received $4,000 cash investment from bob johnson, the owner of the business received $850 from a customer in partial payment of his account receivable which arose from sales in june. provided services to a customer on credit, $475. borrowed $7,000 from the bank by signing a promissory note. received $1,350 cash from a customer for services to be rendered next year. what was the amount of revenue for july?

Answers: 1

You know the right answer?

Given the following information about a fully amortizing loan, calculate the lender's yield (rounded...

Questions

History, 18.07.2019 07:00

Mathematics, 18.07.2019 07:00

Biology, 18.07.2019 07:00

Mathematics, 18.07.2019 07:00

Biology, 18.07.2019 07:00

Health, 18.07.2019 07:00