Business, 14.03.2020 05:29 bskyeb14579

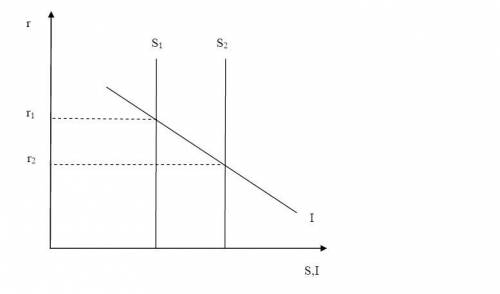

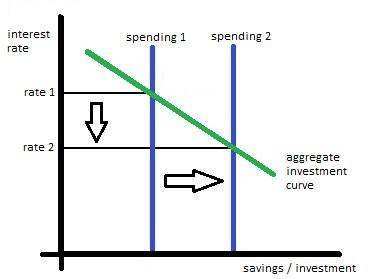

A. Suppose a government moves to reduce a budget deficit. Using the long-run model of the economy developed in Chapter 3, graphically illustrate the impact of reducing a government's budget deficit by reducing government purchases. Be sure to label: i. the axes; ii. the curves; iii. the initial equilibrium values; iv. the direction curves shift; and. the terminal equilibrium values. b. State in words what happens to: i. the real interest rate;ii. national saving; iii. investment; iv. consumption; and v. output

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

Alocal barnes and noble bookstore ordered 80 marketing books but received 60 books. what percent of the order was missing?

Answers: 1

Business, 22.06.2019 17:30

Which curve shows increasing opportunity cost as you give up more of one option? demand curve bow-shaped curve yield curve indifference curve

Answers: 3

Business, 22.06.2019 20:00

Question 6 of 102 pointswhich situation shows a constant rate of change? oa. the number of tickets sold compared with the number of minutesbefore a football gameob. the height of a bird over timeoc. the cost of a bunch of grapes compared with its weightod. the outside temperature compared with the time of day

Answers: 1

Business, 23.06.2019 00:00

1. consider a two-firm industry. firm 1 (the incumbent) chooses a level of output qı. firm 2 (the potential entrant) observes qı and then chooses its level of output q2. the demand for the product is p 100 q, where q is the total output sold by the two firms which equals qi +q2. assume that the marginal cost of each firm is zero. a) find the subgame perfect equilibrium levels of qi and q2 keeping in mind that firm 1 chooses qi first and firm 2 observes qi and chooses its q2. find the profits of the two firms-n1 and t2- in the subgame perfect equilibrium. how do these numbers differ from the cournot equilibrium? b) for what level of qi would firm 2 be deterred from entering? would a rational firm 1 have an incentive to choose this level of qi? which entry condition does this market have: blockaded, deterred, or accommodated? now suppose that firm 2 has to incur a fixed cost of entry, f> 0. c) for what values of f will entry be blockaded? d) find out the entry deterring level of q, denoted by q1', a expression for firm l's profit, when entry is deterred, as a function of f. for what values of f would firm 1 use an entry deterring strategy?

Answers: 3

You know the right answer?

A. Suppose a government moves to reduce a budget deficit. Using the long-run model of the economy de...

Questions

Mathematics, 06.03.2021 02:20

Mathematics, 06.03.2021 02:20

Mathematics, 06.03.2021 02:20

Mathematics, 06.03.2021 02:20

Chemistry, 06.03.2021 02:20

History, 06.03.2021 02:20

Mathematics, 06.03.2021 02:20

Mathematics, 06.03.2021 02:20

Computers and Technology, 06.03.2021 02:20

Mathematics, 06.03.2021 02:20