Business, 16.03.2020 16:30 gachaperson123

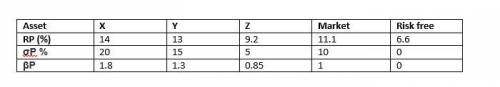

You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio RP σP βP X 14.0 % 20 % 1.80 Y 13.0 15 1.30 Z 9.2 5 0.85 Market 11.1 10 1.00 Risk-free 6.6 0 0 What is the Sharpe ratio, Treynor ratio, and Jensen’s alpha for each portfolio?

Answers: 3

Another question on Business

Business, 21.06.2019 21:10

Of the roles commonly found in the development, maintenance, and compliance efforts related to a policy and standards library, which of the following has the responsibilities of directing policies and procedures designed to protect information resources, identifying vulnerabilities, and developing a security awareness program?

Answers: 3

Business, 23.06.2019 02:30

Harmon inc. produces joint products l, m, and n from a joint process. information concerning a batch produced in may at a joint cost of $75,000 was as follows:

Answers: 3

Business, 23.06.2019 03:00

To assess the risk and return involved in a purchase decision, which practical questions should a potential buyer ask? select three options. what can go wrong? what are the alternatives? how will it affect my status in society? what is the likely return? is the risk worth the return?

Answers: 2

You know the right answer?

You are given the following information concerning three portfolios, the market portfolio, and the r...

Questions

History, 22.09.2019 21:20

Mathematics, 22.09.2019 21:20

History, 22.09.2019 21:20

Mathematics, 22.09.2019 21:20

Mathematics, 22.09.2019 21:20

Mathematics, 22.09.2019 21:20

Computers and Technology, 22.09.2019 21:20

Mathematics, 22.09.2019 21:20

Arts, 22.09.2019 21:20

Social Studies, 22.09.2019 21:20

Mathematics, 22.09.2019 21:20

Mathematics, 22.09.2019 21:20