Business, 16.03.2020 16:56 elissiashontelbrown

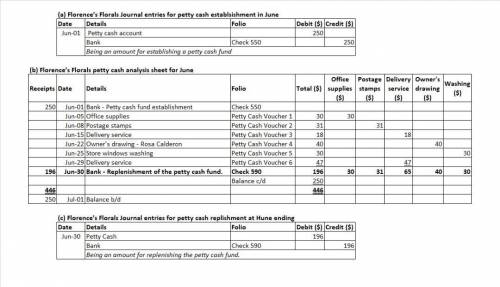

Florence’s Florals, a retail business, started a $250 petty cash fund on June 1. Below are descriptions of the transactions to establish the petty cash fund, disburse petty cash during June, and replenish the petty cash fund on June 30. DATE TRANSACTIONS June 1 Issued Check 550 for $250 to establish a petty cash fund. 5 Paid $30 from the petty cash fund for office supplies, Petty Cash Voucher 1. 8 Paid $31 from the petty cash fund for postage stamps, Petty Cash Voucher 2. 15 Paid $18 from the petty cash fund for delivery service, Petty Cash Voucher 3. 22 Paid $40 from the petty cash fund to the owner, Rosa Calderon, for her personal use, Petty Cash Voucher 4. 25 Paid $30 from the petty cash fund to have the store windows washed, Petty Cash Voucher 5. 29 Paid $47 from the petty cash fund for delivery service, Petty Cash Voucher 6. 30 Issued Check 590 for $196 to replenish the petty cash fund. Required: Record the transaction to establish the petty cash fund on June 1 in a general journal. Record all transactions on a petty cash analysis sheet. Record the transaction to replenish the petty cash fund on June 30 in the general journal.

Answers: 3

Another question on Business

Business, 22.06.2019 04:10

You are head of the schwartz family endowment for the arts. you have decided to fund an arts school in the san francisco bay area in perpetuity. every 5 years, you will give the school $ 1 comma 000 comma 000. the first payment will occur 5 years from today. if the interest rate is 5.9 % per year, what is the present value of your gift?

Answers: 1

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

Business, 22.06.2019 21:50

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

Business, 22.06.2019 22:20

Which of the following is correct? a. a tax burden falls more heavily on the side of the market that is more elastic.b. a tax burden falls more heavily on the side of the market that is less elastic.c. a tax burden falls more heavily on the side of the market that is closer to unit elastic.d. a tax burden is distributed independently of the relative elasticities of supply and demand.

Answers: 1

You know the right answer?

Florence’s Florals, a retail business, started a $250 petty cash fund on June 1. Below are descripti...

Questions

History, 02.01.2020 04:31

Computers and Technology, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Biology, 02.01.2020 04:31

English, 02.01.2020 04:31

Chemistry, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Chemistry, 02.01.2020 04:31

Mathematics, 02.01.2020 04:31

Chemistry, 02.01.2020 04:31

Health, 02.01.2020 04:31