Business, 16.03.2020 21:11 solikhalifeoy3j1r

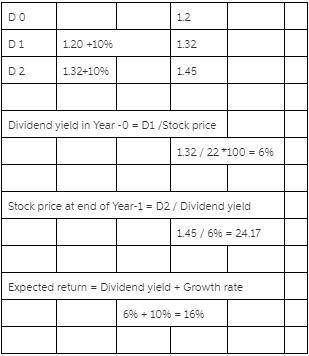

Woidtke Manufacturing’s stock currently sells for $22 a share. The stock just paid a dividend of $1.20 a share (i. e., D0 5 $1.20), and the dividend is expected to grow forever at a constant rate of 10% a year. What stock price is expected 1 year from now?

Answers: 3

Another question on Business

Business, 22.06.2019 16:40

Differentiate between the trait, behavioral, and results-based performance appraisal systems, providing an example where each would be most applicable.

Answers: 1

Business, 22.06.2019 19:00

The demand curve determines equilibrium price in a market. is a graphical representation of the relationship between price and quantity demanded. depicts the relationship between production costs and output. is a graphical representation of the relationship between price and quantity supplied.

Answers: 1

Business, 22.06.2019 20:00

In myanmar, six laborers, each making the equivalent of $ 2.50 per day, can produce 40 units per day. in china, ten laborers, each making the equivalent of $ 2.25 per day, can produce 48 units. in billings comma montana, two laborers, each making $ 60.00 per day, can make 102 units. based on labor cost per unit only, the most economical location to produce the item is china , with a labor cost per unit of $ . 05. (enter your response rounded to two decimal places.)

Answers: 3

Business, 23.06.2019 08:20

As task uncertainty and interdependence increase, are a more effective coordination mechanism than

Answers: 3

You know the right answer?

Woidtke Manufacturing’s stock currently sells for $22 a share. The stock just paid a dividend of $1....

Questions

Mathematics, 04.03.2021 21:40

Mathematics, 04.03.2021 21:40

Mathematics, 04.03.2021 21:40

Social Studies, 04.03.2021 21:40

Mathematics, 04.03.2021 21:40

Mathematics, 04.03.2021 21:40

Mathematics, 04.03.2021 21:40

Mathematics, 04.03.2021 21:40